Wow! again what a week in all of the markets. Gold is continuing to slowly build into a major rally, look for $1050 to go down this time! We have seen the retracement in the stocks (normal retracement) in a very bear marketas I also mentioned earlier. I still have my 720 Sp 500 puts and look for a nice pop before next weeks expiration. Continue to accumulate more mining stocks and I hope you got in to DGP when I did and let you know via twitter on Monday. The winner if you haven’t guessed is Gold! We have a new player entering into the melee. Crude Oil has finally flashed it’s first buy signal in 18 months. Look for strong resistance at the $50 mark. If it clears then we’re back to $80 minimum, probably $100 in the first leg. I would play this one slowly as there still is a huge pool sitting out there in tankers to be used up first before we can get into a serious rally in Crude Oil and distillates. One thing to mention is our President Obama, at least he waited until the close of markets before speaking yesterday, it almost seems he is determined to drive the stock markets down. If the Dow doesn’t hold here then the 5000 range for the Dow is not out of the question in fact a very real possibility; a full 70% retracement would actually take us down to the 4500 level. Protect yourself and Buy Gold any form and BUY it NOW! Good Investing! jschulmansr

Follow Me on Twitter and be notified whenever I make a new post!

Schedule automatic tweets, Send Automatic Thankyou for following me messages, and much more! Be More Productive- Free signup… TweetLater.com

Claim a gram of FREE GOLD today, plus a special 18-page PDF report; Exposed! Five Myths of the Gold Market and find out:

· Who’s been driving this record bull-run in gold?

· What Happens When Inflation Kicks In?

· Why most investors are WRONG about gold

· When and How to buy gold — at low cost with no hassle

Get this in-depth report now, plus a gram of free gold, at BullionVault here…

===========================================================

A new site that is in pre-launch state that will become a virtual world – chat, shop, play, videos, etc. Anyways they are giving free shares (that should become actual company shares) to anyone who signs up and more shares if you refer people. me2everyone.com

=========================================================

Source: INO.com

For the first time since September of 2007, the crude oil (NYME_CL) market has flashed a positive signal that it is headed higher. This is the first buy signal that we have seen in over 18 months in the energy markets.

The big question is, if crude oil is headed higher, how much of a price increase can the US economy afford and withstand?

Here is a raw commodity that is used by everyone and the US has no control over. This key commodity to commerce just happens to be in areas that are normally hostile to the US. If we see a hiccup in the supply chain that changes this market dynamic, even for a short time period, we could see oil move back to the $80/barrel range in a heart beat.

So how will this affect the US equity markets? If crude oil heads back to the $75-$80 range, I expect that the major indices will head south. I call it the 551 syndrome. 5000 on the Dow, 500 on the S&P 500, and finally 1000 on the NASDAQ.

In this short video I will share with you the potential target zones we could see in the next 6 to 12 months in crude oil.

So with the trend in crude oil in a positive trajectory and the trend in the US equity markets in a negative trajectory, I think the two will feed off themselves. Look for traders and hedge funds to move aggressively in both these areas with abandon.

Lastly with no reinstatement of the up-tick rule, expect stocks to once again get pummeled to oblivion.

Enjoy the video and all the best in trading,

Adam Hewison

President, INO.com

Co-founder, MarketClub

=============================================================

Sell the Swiss Franc, Buy Gold- Seeking Alpha

Source: FP Trading Desk

“Forceful relaxation” – it brings to mind a trader at a Mexican beach resort, not Swiss monetary policy, but that is exactly what the Swiss National Bank (SNB) announced in its Monetary Policy Assessment Wednesday, joining a growing chorus of central banks engaging in quantitative easing. Sell the franc and buy gold.

The SNB cut its target range for three-month Libor by 25 basis points to a range of 0–0.75% and announced plans to purchase domestic bonds from the private sector and sell francs in the open market. The resulting biggest ever one-day drop in the franc versus the euro and dollar is likely to be followed by franc depreciation over the next year.

Swiss lending to foreigners brings new meaning to Lord Polonius’s advice to Laertes to “neither a borrower nor a lender be.” The Swiss risk losing more than the friendship of the Hungarians who borrowed extensively in Swiss Franc between 2006 and 2008. They also risk losing their money as Eastern Europe struggles under a mountain of debt. All told, Swiss banks claims on foreigners rose from five times Swiss GDP in 2000 to roughly eight times GDP in mid-2007, according to the Bank for International Settlements (BIS).

The majority of these claims are denominated in US dollars, and that factor will continue to put pressure on the franc versus the dollar over the next year. Swiss banks’ net US dollar books approached $300 billion by mid-2007, according to the BIS.

Now that the SNB is actively trying to push the franc down to raise inflation expectations in Switzerland, watch out. This policy raises the prospects for franc depreciation and increases the case for owning gold versus all reserve currencies.

=====================================================================

Related: This is one of a multitude of reasons to Buy Gold-see next article below – jschulmansr

Swiss Action sparks talk of ‘Currency War’ – Financial Times

Source: Financial Times

By Peter Garnham in London

Published: March 12 2009 20:14 | Last updated: March 12 2009 20:14

The Swiss National Bank moved to weaken the Swiss franc on Thursday, the first time a big central bank has intervened in the foreign exchange markets since Japan sought to weaken the yen in 2004.

The bank’s move, which sparked fears that other countries could follow suit, comes as the value of the Swiss franc has soared as investors seek a haven from the recent market turmoil. In October, after the collapse of Lehman Brothers, it rose to a record high of about SFr1.43 against the euro, a level it has come close to again in recent weeks.

But it fell to its lowest level this year on Thursday after the SNB said the currency’s strength represented an “inappropriate tightening of monetary conditions” as it battled against a slowdown in the Swiss economy.

“In view of this development, the SNB has decided to purchase foreign currency on the foreign exchange market to prevent any further appreciation of the Swiss franc against the euro,” the central bank said.

The Swiss franc dropped 2.6 per cent to SFr1.5192 against the euro and dropped 3.2 per cent to $1.1894 against the dollar.

Analysts said the move was likely to increase talk that countries were set to engage in a bout of competitive devaluation.

Analysts said the move was likely to increase talk that countries were set to engage in a bout of competitive devaluation.

“Let the currency wars begin,” said Chris Turner at ING Financial Markets.

Countries around the world faced with the constraint of zero interest rate levels might feel it was acceptable to intervene to weaken their currencies in order to ease monetary conditions, he said, adding that other export-dependent economies such as Japan would “probably be at the head of the queue”.

Michael Woolfolk at Bank of New York Mellon agreed.

“Market intervention by a major central bank such as the SNB opens up the door for other central banks, namely the Bank of Japan, to follow suit,” he said. “The yen is widely perceived in Japan to be overvalued.”

The SNB also cut its interest rates by 25 basis points, taking its three-month Libor target range down to zero to 0.75 per cent, and announced plans to adopt a quantitative easing approach to monetary policy.

Analysts said the move towards quantitative easing was sparked by a drastic revision to the central bank’s forecast for growth, which is now expected to fall between 2.5 and 3 per cent in 2009, much worse than its previous forecast of a drop of between 0.5 and 1 per cent.

The SNB said economic conditions had deteriorated sharply since its last policy meeting in December and that there was a risk of deflation over the next three years.

“Decisive action is thus called for, to forcefully relax monetary conditions,” the central bank said.

Additional reporting by Haig Simonian in Zurich

Copyright The Financial Times Limited 2009

====================================================

John Embry: Gold and Silver Are the Ultimate Insurance Policy- Seeking Alpha

By: Andrew Mickey of Q1 Publishing

John Embry: Exclusive Interview with Canada’s Foremost Gold Investor

Is gold the next “hot” investment? Or will it never break through the $1,000 threshold?

Some of the world’s leading investors are currently placing their bets.

For instance, hedge fund manager David Einhorn recently bet big on gold. Einhorn manages $6 billion at Greenlight Capital and has averaged a 20% annualized return by booking only one losing year since 1996 (last year). His fund recently bought more than $200 million of SPDR Gold Trust ETF (NYSE:GLD) and more than $75 million worth of Market Vectors Gold Miner ETF (NYSE:GDX).

On top of that, the big money managers have already pumped billions of dollars directly into gold mining companies to fund takeovers and new mines and expansion.

It’s looking like a lot of smart and big money is betting on gold. And as the financial markets, economy, and future outlook worsen, gold is holding up as a last bastion of hope for many investors.

How can you get in on it? Is it just gold? What about silver? Where are the real values to be had? What about other hard assets – water, agriculture, etc.?

It’s best to start getting prepared now.

Most recently, Q1 Publishing’s own Andrew Mickey, editor of the Prosperity Dispatch, had a private one-on-one conversation with John Embry, one of the leading gold investors in the world.

Embry has been following the gold sector for 35 years (that’s since the early 1970’s) and is one of the leading authorities on gold. Embry is currently the Chief Investment Strategist for Sprott Asset Management – a legendary name to long-time gold investors.

Prior to joining Sprott, Embry oversaw more than $5 billion in assets including the Royal Precious Metal Fund as VP, Equities and Portfolio Manager for RBC, a top-tier Canadian bank. Under his watch, the Royal Precious Metals Fund returned 153% in 2002 and was ranked #1 across all funds in Canada (remember 2002 was a horrible year for stocks as tech stocks continued to fall).

Andrew Mickey: Precious metals have been getting a lot of attention lately. But it seems like there has been a divergence between gold and silver. We’ve been watching the gold to silver ratio (the number of ounces of silver which can be bought for an ounce of gold) get wider and wider. Gold to platinum too. Do you see the divergence tied to the industrial aspect of metals like platinum and silver, gold is the supreme precious metal, or is there something else going on behind the scenes?

John Embry: No – it’s a very strong manipulative aspect at work. If you go to the COMEX and look at the trading patterns and the short positions and such, clearly the prices are being messed around with.

Silver is a smaller market and can be messed around with more easily. I think silver probably has a bit more upside potential because the price is so far behind where it should be.

Andrew Mickey: So do you see silver as one of the bright spots?

John Embry: Oh yeah, it’s an extreme bright spot. I could easily see it three times where it is now in the not-that-distant future.

Andrew Mickey: As far as gold supply, there is one period in the world gold supply where gold production kind of crested around 2007 or 2008. Are we facing a “Peak Gold” kind of situation?

John Embry: Yeah, we have most assuredly crested in terms of mine supply without question.

Andrew Mickey: So, when you look at five, ten years out…let’s say in a world where gold is $2000 or $3000 or higher, how much more gold can realistically be produced in a year?

John Embry: Zero, I think. In fact, I think you probably need a lot more lead time – maybe five to ten years.

Just look at what happened in the ‘70s. The gold price went from $35 to $800 and, believe it or not, gold production was at a lower level worldwide after that 10-year period.

Now, the big question is what will happen this time? Number one, a lot of the existing mines are being depleted quite rapidly. Number two, when the gold price goes up a lot, mines generally tend to sort of drop the grade they mine because they can make a lot of money with lower grade and they can keep the good stuff for the bad times.

So by definition, they will be mining in the same number of tons but they will be taking the gold grade out of it, so collectively they will be mining less gold. They will make more money because the price is up but they will be mining less.

The other problem is that so many of the new interesting deposits that may or may not be developed in the future are located in these God-awful third world countries. They are having a real battle now with the governments, getting permitting, deciding who makes the money out of the mine, environmental issues etc. The gold deposits are all over the place and the governments are going to delay projects.

Say you find an ore body today. It would probably take a minimum of five years before the gold hits the market with all the attendant problems there are getting it into production. So all that’s already baked in the cake. The gold price could be doing anything it wanted for the next four or five years…gold production isn’t going to increase much – if any – at all.

Andrew Mickey: Amazing, gold production declining in the last great bull market for gold. So what does this mean for gold stocks, from your perspective? Where should we focus our investments across the whole range – from explorers all the way up to the majors?

John Embry: Right now, I think the majors are reasonably priced compared to the overall list. People have sort of focused on liquidity so they have gone after the majors and they bid them up aggressively and left a lot of the more illiquid situations behind.

That will all change. As gold becomes more popular and the price rises, at that point, money will filter down the food chain from the larger companies and they will go looking for the good quality smaller ones.

I particularly like some of the smaller producers now for a lot of reasons.

For one, they are going to make a ton of money in the current environment, particularly if they are producing outside the United States. Like some of the ones that are producing in Canada. The gold price yesterday was I believe $1,230 Canadian.

Another reason is because all of the costs of gold mining are dropping right now. Energy costs, steel prices, and all the things that went up so much and really hurt gold miners’ profitability. They are all going the other way now and at the same time the price of gold is going up. So I think that people are going to be pleasantly surprised going forward by the profitability of some of these mines, which have struggled up until recently.

So I am pretty bullish on small producers and anybody who has got a legitimate ore body that can be exploited sometime within the foreseeable future. I think they are going to be viewed positively too.

But the key thing to focus on is when their production will begin. If they don’t have to worry about getting through the environmental hurdles and getting the finance and et cetera, et cetera, they are going to make a lot of money.

Andrew Mickey: What do you see as the potential risks of politics and environmental concerns preventing anyone from starting production?

John Embry: They are not necessarily preventing a company from going into production, but they are certainly delaying it.

My favorite example is that probably the best ore body that’s been discovered in the last 10 years is Aurelian’s in Ecuador; which was subsequently acquired by Kinross (KGC). But the fact is, as long as the current government in Ecuador stays in power…I just don’t see the thing entering production.

So that’s what I am talking about. It’s such a fabulous mine if it were in a good geopolitical environment. It would be being built as we speak, but there is no progress towards building it at this point.

Andrew Mickey: The gold ETF (like the GLD) has been the number one recommended way to invest in gold in the U.S.

It’s a hot subject of debate by those who are new to gold and those which have been following it for while. The new people to gold always recommend the GLD. What are your thoughts?

John Embry: Well, they are just plain wrong in my opinion.

I think gold and silver are the ultimate insurance policy. When things got really bad in the system you want to make sure the vehicle you own has the gold and silver that it allegedly is supposed to have.

Now, I may buy gold and have it in my own possession. I know I have it. And then there are other gold and silver vehicles like Central Fund of Canada (NYSE:CEF) or Central Gold-Trust (NYSE:GTU), to cite a couple, where the gold is allocated. It’s in a vault and there are regular audits to prove everything that’s behind the vehicle is in fact there. So you are getting what you pay for.

Now, in the case of the ETF I am not totally sure. I mean if you read their prospectuses closely enough you’ll see there is some wiggle room. What they are trying to do is just track the gold price so you don’t necessarily need the physical gold. They could be using paper derivative types of products to back the stock.

What really made me kind of uncomfortable recently, was there was this dramatic ramp up in the amount of money going into the GLD ETF in particular. I looked around and I am going like, where is gold coming from?

As you know, the gold market is acknowledged by virtually everybody to be tight. I know mine supply is falling, I know that – I didn’t see any appreciable change in any of the inventory levels or any of the recognized exchanges like COMEX etc., and there was no particular acceleration in the Central Bank dispositions. So my question is, if suddenly all this new buying appeared because of the ETF having to sort of stock up, where did the gold come from?

I am not sure it bought any gold. I think they might have gone to COMEX and just bought a paper contract.

I don’t know. I just think there are better vehicles than ETFs.

Andrew Mickey: Switching gears a little bit here, let’s talk about the big picture. Everyone wants to know what’s going on.

It’s a crazy time. What’s your take? What going on in the general markets and where are we headed?

John Embry: I think we are probably headed for the worst economic debacle since the Depression – if not worse than that.

And the response for that by governments around the world is going to be, I think, a blizzard of paper money creation. They will run massive deficits, trying to prop up these economies.

So I think the major development is going to be ongoing issues of currency debasement. The value of paper money against real tangible assets is going to fall considerably. Right now, we are going through this deflationary scare. It won’t last. It will change into a hyperinflationary environment in the not too distant future.

Andrew Mickey: A kind of stagflationary situation like we saw in the 1970’s?

John Embry: No, worse than that. I think the inflation would be more intense. The decline in economic activity will probably be worse.

Andrew Mickey: What are the kinds of conditions that bring us to that state? Is it avoidable?

John Embry: Basically, we have already put the conditions in place. We ran economies with constantly too much leverage and debt.

Eventually, you reach a certain point where you can’t really add any more debt because the capacity for the system to handle it has been exhausted. Once it reverses, it’s very hard to change. They are going to try to change it by simply debasing the money.

Andrew Mickey: You seem to focus on the debasement of currencies as a government “solution” – for lack of a better term – to the problem. What are some of the best ways to protect ourselves from this situation? Which are you employing?

John Embry: Our strategy is pretty simple. What we really like is the monetary precious metals gold and silver. We don’t like anything in the financial sphere at this time. The companies that we like are the more solid companies providing basic services and what have you. We like the ones which don’t have overly leveraged balance sheets.

Andrew Mickey: What about other real asset classes. There are other sectors I know you follow outside of precious metals like agriculture. That’s the one thing that I’ve been completely excited about for years, but had to turn and run from over the summer. What’s your take on it now? Is it time to wade back in?

John Embry: Well, I am with you on agriculture. It’s a necessity that we must eat.

I guess one of the positive aspects of global growth is that the third world became a bit more affluent. Improvement in their diets put more demand into the world for basic food stuffs. Now that’s slowed down a bit.

I think the real arbiter in the short run might be the climate. I see a lot of industry people bringing this up, changing sunspots. These changes in the sunspots suggest that we may be facing drought conditions in a lot of the world all at the same time.

If that’s the case, I think you are going to see massive food shortages which would underrate a considerable price appreciation in the food because there will be a real fight for it.

Andrew Mickey: So, I don’t want to get too technical with this subject, I assume that you’re referring to increasing activity in sunspots?

John Embry: Yes, there is increasing activity in sunspots; which apparently, sort of cools the world out. It’s really interesting because there has always been, as you know, there is debate about global warming.

I do believe that all this carbon release is creating global warming, but at the same time, we have this mass of long cycles in nature which sort of move from the ice age then back to a period where it gets too hot. In that cycle, we are headed towards cooling again and the sunspot is just one aspect of it.

Andrew Mickey: Can the sunspots cause some of the farming areas to change?

John Embry: Yes, they do. They have a role – for whatever reason – they have a major impact on increasing odds of getting hit by a drought. We have a lot of droughts going on in the world currently. There are droughts in Australia, South America, Northern China and Africa. But Africa has always had a drought.

There is a lot of food supply interruption. If a drought were to strike North America then that would really create a problem. I have seen some work suggesting that we are due for a drought based on certain cycle work.

Andrew Mickey: Okay, this is more or less an agricultural cycle that you are referring to I imagine. How long is this kind of agriculture cycle? Is it like an 80-year almost Dust Bowl scenario type?

John Embry: Well, yes…I hesitate to go there because…it’s like Murphy’s Law, “everything goes wrong at the same time.” And with the financial world right now in a mess the last thing we need is a sort of replay of the ‘30s in the agricultural space.

The pessimists among us think that there is a good probability that drought conditions could strike North America, and that would be the last thing I want to see.

Andrew Mickey: What about farmland then? It’s an asset class which has had extremely consistent returns over the past 50 to 60 years. But, we’ve been waiting for a time like this.

John Embry: Farmland prices have fallen off a cliff. I just saw a guy in Minneapolis; again, he was saying that farmland is on offer everywhere right now.

This is a great thing. I am now in favor of buying farmland at the right price and that price is probably – as we are cleaning this whole mess up – the right price is going to be reached.

Andrew Mickey: The same is true for all kinds of natural resources. Oil, natural gas, copper, iron ore, uranium, etc. They’re all over the world and the government s which control them are in position to really inhibit or assist private companies who want to exploit them.

Recent US policy changes favor certain alternative energies. The one that really concerns me is uranium. In your opinion, when we look at uranium, should we look at it as declining uranium supply from current mines and or how new power plants can come on line if they can’t get it? Which is the real problem? Or is it both?

John Embry: Excellent question. I do think there is a problem. The Cigar Lake up in Northern Saskatchewan has gone through all sorts of problems. Another major problem area is with the Olympic Dam mine in Australia. It has been having problems too.

So again, there’s an issue with existing production.

In that light, I think that’s going to make new discoveries. Quality discoveries in uranium which are really worthwhile and the problem, again, is how long it’s going to take to exploit them. There just aren’t too many good deposits. We had that huge run in uranium a couple of years ago, but a lot of the deposits were really junky.

The great advantage in uranium is that the true cost of producing the power, is in building the reactor. So, there’s a lot of flexibility there. They don’t care about what they have to pay for uranium just as long as they can get it.

So I think that’s one of the aspects I like about uranium. The price is sort of inelastic in that sense. Just because the price goes up doesn’t mean it’s going to start to reduce demand.

Andrew Mickey: With respect to potash, nitrogen and phosphate, where do you see opportunities there? Most people are familiar with potash, the high capital costs to build a mine and the like. Are there any opportunities in nitrogen and phosphate because it’s too easy, how do you guys kind of look at those

John Embry: Well, we actually – we meaning our Sprott Resource Corp – have been looking around for interesting opportunities in phosphate and what have you. We believe that as this whole agricultural thing unfolds that it will be a good business.

But right now, farmers are having trouble getting money like everybody else is. So really, there is a bit of a low in the fertilizer business. Looking for longer term opportunities, the short term is going to be a little problematic.

Andrew Mickey: Are there any other things that you think individual investors should keep in mind as this is the first time in a long time that any of us had to go through a downturn like this?

John Embry: Well, it’s downright ugly out there. I was born in United States and I am a huge admirer of the U.S. I think what’s happened is tragic. Consequently, people are looking to protect themselves and I really do think that precious metals in particular and solid commodity opportunities are going to be one way that’s going to pay off in the end.

Andrew Mickey: What’s your take on all the stimulus packages and infrastructure building and everything that’s going on there?

We have been really bearish on infrastructure companies. How can the government support these businesses which are mostly private?

John Embry: I think that you are right. Typically, the market overacts to these things and obviously the infrastructure spending is partly implied; because, it’s been neglected to such a great extent in North America.

We have the same problem in Canada. Our roads are falling apart. Really, they could spend a ton of money in the sector. Problem is, they don’t have the money. They are going to have to create it out of thin air.

Andrew Mickey: One last thing. Are you currently looking at or investing in water? If so, would you be looking into water rights or a pipe manufacturer for example?

John Embry: We haven’t done as much as we should have. I think water is going to be a major issue going forward.

As for ways to invest in water, I’m more interested in water rights. The good thing about Canada is, there is lots of water up here. The problem is going to be down in the U.S., particularly in Southwest and other areas. I just look at that and I shake my head.

Andrew Mickey: Well, thanks very much for spending some time with us. Is there anything else that you would like to add?

John Embry: Just that I think that it’s important that your readers know all this. The world is a lot different than it was 10 years ago.

Andrew Mickey: And probably it will be a lot different in another 10 years.

John Embry: Well, it would be a lot different looking back from five years from now too, you bet, but I think we will be stood in good stead, certainly being in precious metals and end products, I think those are the two that I like the best.

Andrew Mickey: Well, thanks for your time, I appreciate it.

John Embry: My pleasure. Anytime.

===========================================================

· Who’s been driving this record bull-run in gold?

· What Happens When Inflation Kicks In?

· Why most investors are WRONG about gold

· When and How to buy gold — at low cost with no hassle

Get this in-depth report now, plus a gram of free gold, at BullionVault here…

===========================================================

Have a Great Weekend!-jschulmansr

Follow Me on Twitter and be notified whenever I make a new post!

Schedule automatic tweets, Thankyou for following me message and much more! Be More Productive- Free signup… TweetLater.com

===============================================================

Nothing in today’s post should be considered as an offer to buy or sell any securities or other investments; it is presented for informational purposes only. As a good investor, consult your Investment Advisor/s, Do Your Due Diligence, Read All Prospectus/s and related information carefully before you make any investing decisions and/or investments. – jschulmansr

As you can see, from mid-1971 to December 1974, gold rose 471%. It

then fell 50%, from December ’74 to August ’76. After that, it began

its next leg up, exploding 750% higher from August ’76 to January

1980. Now, in its current bull market (2001 to March 2008), gold

rose over 300% from $250 to a little over $1,000. And just like in

the mid-70s, it began showing signs of weakness after its first big

rally up to $1,014 in March ’08. At one point, it even fell to $700, a 30% retraction.

Granted, it wasn’t a full 50% retraction like the one that occurred

from 1974-76. But we are experiencing a financial crisis. And gold

is the most common catastrophe insurance.

If we were to go by the historic pattern of the gold market in the

‘70s, gold should experience upwards resistance for 19 months after

its first peak today. Gold’s recent peak was $1,014 in March ’08

(roughly 17 months ago). If this bull market parallels the last one,

then gold should renew its upward momentum in a very serious way

starting in October 2009. And this next leg up should be a major

one (the biggest gains came during the second rally in gold’s bull

market in the ‘70s).

The chart certainly forecasts a major move.

As you can see, from mid-1971 to December 1974, gold rose 471%. It

then fell 50%, from December ’74 to August ’76. After that, it began

its next leg up, exploding 750% higher from August ’76 to January

1980. Now, in its current bull market (2001 to March 2008), gold

rose over 300% from $250 to a little over $1,000. And just like in

the mid-70s, it began showing signs of weakness after its first big

rally up to $1,014 in March ’08. At one point, it even fell to $700, a 30% retraction.

Granted, it wasn’t a full 50% retraction like the one that occurred

from 1974-76. But we are experiencing a financial crisis. And gold

is the most common catastrophe insurance.

If we were to go by the historic pattern of the gold market in the

‘70s, gold should experience upwards resistance for 19 months after

its first peak today. Gold’s recent peak was $1,014 in March ’08

(roughly 17 months ago). If this bull market parallels the last one,

then gold should renew its upward momentum in a very serious way

starting in October 2009. And this next leg up should be a major

one (the biggest gains came during the second rally in gold’s bull

market in the ‘70s).

The chart certainly forecasts a major move.

As you can see, gold has formed a long-term inverse head and

shoulders formation (two smaller collapses book-ending a major

collapse). Typically a head and shoulders predicts a massive

collapse. However, when the head and shoulders is inverse, as is

the case for gold today, this typically predicts a MAJOR leg up.

Indeed, any move above the “neckline” of 1,000 would forecast a

MAJOR move up to $1,300 or so. Going by history, this is precisely

the move we should expect: remember based on historical trends

(the gold bull market of the ‘70s) gold should begin its second

and largest leg up in September or October 2009.

Watch the gold chart closely over the next month or so. If gold

makes a move above $980 perhaps add to your current positions.

If it clears $1,000, hold on tight, cause the next leg up in this

secular bull market has begun.

Good Investing!

===================================================

My Note: After watching stocks (DJI) this afternoon and the strange

price behavior before the close, I felt I would add this article too!

-jschulmansr

===================================================

As you can see, gold has formed a long-term inverse head and

shoulders formation (two smaller collapses book-ending a major

collapse). Typically a head and shoulders predicts a massive

collapse. However, when the head and shoulders is inverse, as is

the case for gold today, this typically predicts a MAJOR leg up.

Indeed, any move above the “neckline” of 1,000 would forecast a

MAJOR move up to $1,300 or so. Going by history, this is precisely

the move we should expect: remember based on historical trends

(the gold bull market of the ‘70s) gold should begin its second

and largest leg up in September or October 2009.

Watch the gold chart closely over the next month or so. If gold

makes a move above $980 perhaps add to your current positions.

If it clears $1,000, hold on tight, cause the next leg up in this

secular bull market has begun.

Good Investing!

===================================================

My Note: After watching stocks (DJI) this afternoon and the strange

price behavior before the close, I felt I would add this article too!

-jschulmansr

===================================================

Anytime stocks explode higher on next to no volume and crap

fundamentals you run the risk of a real collapse. I am officially

going on record now and stating that IF the S&P 500 hits 1,000, we

will see a full-blown Crash like last year.

3) This Latest Market Rally is a Short-Squeeze and Nothing More

To date, the stock market is up 48% since its March lows. This is

truly incredible when you consider the underlying economic picture:

normally when the market rallies 40%+ from a bear market low, the

economy is already nine months into recovery mode. Indeed, assuming

the market is trading based on earnings, the S&P 500 is currently

discounting earnings growth of 40-50% for 2010. The odds of that

happening are about one in one million.

A closer examination of this rally reveals the degree to which

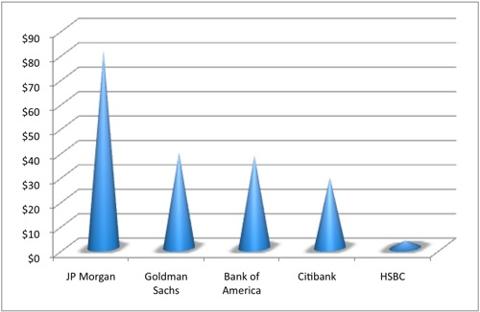

“junk” has triumphed over value. Since July 10th:

Anytime stocks explode higher on next to no volume and crap

fundamentals you run the risk of a real collapse. I am officially

going on record now and stating that IF the S&P 500 hits 1,000, we

will see a full-blown Crash like last year.

3) This Latest Market Rally is a Short-Squeeze and Nothing More

To date, the stock market is up 48% since its March lows. This is

truly incredible when you consider the underlying economic picture:

normally when the market rallies 40%+ from a bear market low, the

economy is already nine months into recovery mode. Indeed, assuming

the market is trading based on earnings, the S&P 500 is currently

discounting earnings growth of 40-50% for 2010. The odds of that

happening are about one in one million.

A closer examination of this rally reveals the degree to which

“junk” has triumphed over value. Since July 10th:

Apparently the gold market and currency markets have heard the news (the chart to the right will be updated as needed over the next hour or so – update #1 from $925 to $932 already complete).

Apparently the gold market and currency markets have heard the news (the chart to the right will be updated as needed over the next hour or so – update #1 from $925 to $932 already complete). Analysts said the move was likely to increase talk that countries were set to engage in a bout of competitive devaluation.

Analysts said the move was likely to increase talk that countries were set to engage in a bout of competitive devaluation.