Tags

agricultural commodities, alternate energy, Austrian school, Bailout News, banking crisis, banks, bear market, Bollinger Bands, bull market, capitalism, central banks, China, Comex, commodities, communism, Copper, Currencies, currency, deflation, Dennis Gartman, depression, diamonds, dollar denominated, dollar denominated investments, economic, economic trends, economy, Federal Deficit, financial, Forex, futures, futures markets, gold, gold miners, hard assets, heating oil, India, inflation, investments, Jay Taylor, Keith Fitz-Gerald, Marc Faber, Mark Hulbert, market crash, Markets, mining companies, Moving Averages, natural gas, oil, palladium, Peter Brimelow, Peter Grandich, Peter Schiff, physical gold, platinum, platinum miners, precious metals, price, price manipulation, prices, producers, production, protection, rare earth metals, recession, risk, run on banks, safety, Saudi Arabia, Sean Rakhimov, silver, silver miners, socialism, sovereign, spot, spot price, stagflation, Technical Analysis, timber, U.S. Dollar, volatility, warrants, Water

Are you secure? If not, you need to be! It’s a dangerous world out there! An unprotected computer is like leaving your keys in the ignition and walking away! Today’s articles include the latest reviews of Security Suites for your computer and latest Gold news. Gold yesterday tested the lower end of support at the $885 oz to $895 oz levels. Today Gold has come roaring back up $16 oz to $908.50. I think we are about to retest the $930 level and if we break that then $950. If we clear those hurdles then the next stop will be $1000 + oz. I am buying on any dips and you should be too! – Good Investing! – jschulmansr

==============================

=================================

The Best Security Suites for 2009 – PC Magazine

Neil J. Rubenking of PC Magazine

Which suite will be best for keeping you safe and not slowing you down this year? We’ve tested them all, and the answer might surprise you!

The list of available 2009-model security suites is now essentially complete. A running theme in this year’s suites is the promise that these new versions will do more for your security while tying up fewer system resources. It’s about time: Users have had it with suites that offer security but bog down the computer. Several vendors have introduced new “in the cloud” technologies to keep up with the accelerating growth of new malware. And many have redesigned their user interfaces to be more attractive and look lighter and faster. Some are new, innovative, and speedy. Others haven’t kept pace. Which are which? I put them all through grueling tests to find out.

Performance Testing

Starting with the 2009 crop of suites, I added an entire day of performance testing per suite to my already lengthy set of evaluations. I wrote and gathered a collection of batch files, scripts, and freeware components to measure how long a number of common activities take on the computer. I ran the scripts many times on a system with no suite installed and then on that same system with each suite installed. Averaging the results let me see just how much each suite affected system performance.

I get a lot of complaints about how long PCs take to boot up in the morning, and many users blame their security suites for lengthening the process. The first part of my test script, therefore, calculates the time it takes from the start of the boot process (as reported internally by Windows) to the time when the system is completely ready to use. “Ready” is a fluid concept—I defined it as meaning that 10 seconds have passed with CPU usage under 5 percent. I ran this test 50 to 100 times and averaged the results; the test system with no suite installed takes almost exactly 60 seconds to boot. Norton Internet Security 2009 and Kaspersky Internet Security 2009 added only about 15 seconds to the boot time. That’s not bad!

Some of the other suites added significantly to boot time. F-Secure Internet Security 2009 and McAfee Total Protection 2009 nearly doubled it, and BitDefender Total Security 2009 more than doubled it. The timings for Webroot Internet Security Essentials (WISE) averaged even higher—almost 2.5 times the baseline. However, the data set included a number of unexplained instances when booting up took 5 or even 10 minutes. Eliminating those quirky outliers brought the average boot time for WISE (the smallest suite) a bit below that of McAfee (the largest suite)—still not impressive.

Real-time malware scanners can kick in on any kind of file access and can slow ordinary file operations, especially if they redundantly scan the same file more than once during the operation. I set up a series of file move and copy actions using a variety of file types and timed how long it took with and without a security suite. Kaspersky added just 2 percent to the time required for this test, and Trend Micro Internet Security Pro added 6 percent. Norton and Panda Global Protection 2009 came in between those two. On the slow side, the system running ZoneAlarm Internet Security Suite 2009 took half again as long to perform the test.

Another of my new tests zips and unzips large groups of files, and my testing showed that this activity takes more of a performance hit from most security suites than moving and copying do. Panda had the lightest touch here, adding just 8 percent to the baseline time. Norton, Kaspersky, Trend Pro, and Webroot all added in the neighborhood of 25 percent to the time. Under ZoneAlarm the zip test took twice as long, and under BitDefender it took 2.5 times as long. That’s dreadful!

Your suite has to keep careful track of software installations so it can prevent malware from installing. I measured the time required for repeated automatic installation and uninstallation of several large Windows Installer packages. Most of the suites added from 20 to 30 percent to this test’s time. Panda excelled again, adding just 6 percent. ZoneAlarm and WISE caused the most drag, adding 63 percent and 71 percent, respectively.

Acting on some reports of problems with media files, I included a test that times some elaborate media file format conversions. None of the suites slowed this test significantly. Their effects ranged from a negligible 1 percent increase by WISE, Panda, and Norton to a still minor 8 percent hit from ZoneAlarm.

Modern suites look at your browsing activity in a number of different ways. They block drive-by downloads, check for fraud, and perhaps block inappropriate content for your kids. To see whether this analysis slows down the browsing experience, I used an ActiveX control that measures when a page has completely loaded, along with a script that launches dozens of URLs with lots of content.

Norton had the least impact on surfing speed, adding 13 percent to the time required for this test. WISE doesn’t do any page analysis beyond checking a blacklist, but it still added 25 percent. Kaspersky and Panda, which did well on most of my other performance tests, slowed browsing by 64 percent and 92 percent, respectively. But McAfee had the worst impact, more than doubling the time required for the surfing test. Given the amount of time the average person spends surfing the Web, this is a bad test to fail.

Check our security suite performance test chart to get full details on each product’s individual scores. Note, though, that in addition to these tests, I considered various other factors. Does the product make a good impression with a speedy and undemanding install process? Is the scan for malware especially fast or slow? Does the spam filter appreciably slow down the process of downloading mail? Are there special features that demonstrably work to minimize performance impact? All these factors go into the final score. In next year’s round of testing I hope to add even more performance tests. In the meanwhile, I’m very interested in getting your feedback on this year’s tests. —next: Security in the Cloud >

Featured in this Roundup:

BitDefender Internet Security 2009

BitDefender Internet Security 2009

![]()

$69.95 direct; 3-pack, $79.95

BitDefender has added a ton of new features—online backup and remote configuration, for example. It includes all the expected security elements, with decent performance from most of them. It’s a reasonable choice if you’re excited by those extra features.

F-Secure Internet Security 2009

F-Secure Internet Security 2009

![]()

$75.90 direct; 3-pack, $79.90

F-Secure Internet Security 2009 is easy to use, without complicated settings and extras. But installing it was a nightmare, and it took too long deleting inactive malware. The firewall is old-fashioned, and the antispam and parental-control apps are ineffective. The suite hasn’t kept up with the times.

Kaspersky Internet Security 2009

Kaspersky Internet Security 2009

![]()

3-pack, $79.95 direct

Kaspersky Internet Security’s new user interface hides messy security details but leaves them accessible to power users. The new application-filtering feature renders the suite smart enough to make its own decisions without hassling the user. As long as you don’t plan to rely on it for spam filtering or parental control, Kasperksy’s suite is a good choice.

McAfee Total Protection 2009

McAfee Total Protection 2009

![]()

3-pack, $79.99 direct

McAfee’s latest suite has improved malware detection, and its spam filter is also much better. But its overabundance of features hasn’t changed at all; its UI is sluggish; and it saps system performance.

Norton Internet Security 2009

Norton Internet Security 2009

![]()

3-pack, $69.99 direct

This is definitely the slimmest, most unobtrusive Norton ever. Its protection is top-notch where it counts, though antispam and parental controls are still weak. As the best all-around security suite to date (I’ll be installing it myself), it’s our new Editors’ Choice.

Panda Global Protection 2009

Panda Global Protection 2009

![]()

$69.95 direct; 3-pack, $89.95

Except for the new main screen, Panda’s 2009 suite doesn’t look much different. Its collective intelligence promises better protection, but its action is spotty: Spam filtering got much better; spyware protection got worse. And it’s expensive! Wait for next year’s version if you’re thinking of switching to Panda.

Trend Micro Internet Security Pro 2009

Trend Micro Internet Security Pro 2009

![]()

3-pack, $69.95 direct

Trend Micro Internet Security Pro v2 is a big improvement over last year’s edition. It’s an effective anti-malware tool, and it’s loaded with Pro features that are truly useful. If you’ve sworn a lifelong grudge against Norton (our Editors’ Choice suite), give Trend Pro a try.

Webroot Internet Security Essentials

Webroot Internet Security Essentials

![]()

3-pack, $59.95 direct

WISE omits features that other suites include yet still slows down system performance. Its malware protection is excellent, and it delivers 2GB of online backup, but its firewall component doesn’t do the job. Spend $10 more and get Norton or Trend Pro!

ZoneAlarm Internet Security Suite 2009

ZoneAlarm Internet Security Suite 2009

![]()

$49.95 direct; 3-pack, $69.95

ZoneAlarm is strong on defense. It has a tough firewall and keeps malware totally out of a clean system, but it’s less effective in cleaning up entrenched malware, and some of its features are antiquated. ZoneAlarm is still a fine choice, but I had hoped for a makeover that would be more than skin deep.

CA Internet Security Suite Plus 2009

![]()

5-pack, $79.99 direct

There’s little to love in this Frankenstein’s monster of a suite. Patched together from many separate mediocre tools, it put the biggest drag on system performance of any suite tested. Save ten bucks and get Norton’s suite (or Trend Micro’s) instead.

Comodo Internet Security 3.5

![]()

Free

For free security Comodo’s firewall is still a sound choice, but the antivirus and antispyware parts of this suite just don’t do the job. If you need free security, get the firewall alone and add avast! or AVG for free virus/spyware protection.

The number of different malware threats and variants released every day is increasing exponentially, and with it the size of the signature files needed by security software to detect these threats. Security vendors have handled this problem in part by using heuristic techniques that allow one signature to match multiple threats. This year several vendors have introduced new technology that moves the signature database at least partially off your local computer and into the cloud. All of these technologies require an Internet connection to function, of course.

Panda calls its new cloud security technology collective intelligence. The suite retains a local malware database of the most common threats and threats that can propagate without an Internet connection. For files not identified by the local list, Panda Global Protection 2009 sends a tiny checksum to the online database to see if it matches the checksum for a known bad program. It’s a good idea and may work eventually, but I didn’t see evidence of improved malware detection when testing Panda.

The Artemis technology in McAfee Total Protection 2009 aims to eliminate the gap between detection of a new threat and protection against that threat. When the local McAfee installation detects slightly suspicious behavior in a file that’s not in its local database of threats, it shoots a checksum off to the Artemis database of known good and known bad files. It’s similar to Panda’s system, but, unlike Panda, McAfee showed a marked improvement in its malware detection.

Symantec’s Norton Insight takes a rather different approach. It leverages data collected from over 25 million Norton users to create a database of known programs and uses proprietary statistical analysis to assign a trust level to each. Skipping known trusted programs markedly speeds up scanning. Symantec researchers believe that statistical methods may in time completely replace familiar signature-based malware detection. It’s certainly effective in combination with regular signature-based detection: Norton scored better than any other suite or standalone antispyware utility on the current round of tests. —

next: Makeovers, Shallow and Deep >

Security suite vendors have finally caught on to the fact that most of their users aren’t security geeks. Users want the product to work; they want it to show that it’s working; but they don’t want any interruptions or confusing queries. Judging from what the vendors have done this year, they also want it to look nice. Many of the suites discussed here have significantly changed their main windows since last year. Click on our security suites interface slideshow to see how the suites have changed.

F-Secure and McAfee bucked the makeover trend. Other than a minor change in color palette, F-Secure looks exactly the same, and only the sharpest eye could detect any difference in McAfee’s 2009 edition. The biggest change for Trend Pro is a new My Home Network tab on the main screen; other changes are relatively minor.

Kaspersky moved things around and smoothed out the overall visual effect, but it’s not too different. BitDefender—the quick-change artist of the group—has undergone some big changes. The 2008 edition swapped 2007’s blocky, utilitarian look and red and silver color scheme for a super-simplified big-button view reminiscent of Microsoft’s OneCare, and the 2009 edition of BitDefender is another complete makeover.

ZoneAlarm has changed the most of all. For years, it has used an awkward dual-tab system, which left some users confused about where to find features, and a hodgepodge of bright-colored icons. ZoneAlarm 2009’s interface is much more coherent, both in function and appearance. Norton has made some big changes, too, getting rid of the confusing separate “Norton Protection” tab. Check the slideshow for before and after pictures.

So, do these radical changes in appearance represent big improvements in functionality? In most cases, no. The biggest exception is Norton: In addition to merely cosmetic changes, it has also streamlined its protection and added visuals for performance-related features such as Norton Insight and the handling of security tasks in idle time.

In the past I’ve given each security suite separate ratings for Firewall, Antivirus, Antispyware, Antispam, and Privacy/Parental Control. With this round of suite reviews I’ve added a Performance category and separated Privacy and Parental Control. Of course, some components are more important than others. I give much more weight to the firewall, antivirus, and antispyware components, as well as to the new Performance index. The attached chart pulls together the individual component ratings for the 2009 suites, so you can focus on choosing one that’s strong in the areas you need most.

Norton Internet Security 2009 excelled in the most important areas—firewall, antivirus, and antispyware—and it did so with little affect on performance. Its antispam and parental-control elements are dismal, but many users don’t need those. Norton remains our Editors’ Choice for 2009. Those who’ve sworn off Norton’s suite for life (there are some who can’t get beyond its past performance problems) should consider Trend Micro Internet Security Pro 2009. Its scores are impressive, if not quite as high as Norton’s, and it does well in all areas, including those where Norton falls down. Click the links below for full reviews.

The number of players in many industries keeps shrinking as small vendors fail or get eaten by bigger ones, especially in the current financial climate. Not so with the makers of consumer-side security suites! Some vendors take a single-focus product, such as an antivirus or a software firewall, and parlay it up into a suite. Others modify their Enterprise-level products hoping to generate a separate revenue stream on the consumer side. These new suites haven’t necessarily settled into the “fall model year” schedule adopted by their existing competitors. In fact several have popped up since my roundup of 2009 suites. The current top suites don’t have to worry about the competition yet-all three of these newcomers need work-but the category as a whole is clearly healthy.

TrustPort is well-known for its Enterprise and gateway products but hasn’t been a force in the consumer market. Recently the company quietly released a consumer version of its TrustPort PC Security 2009. The product has some features not usually found in consumer products-one, an antivirus/antispyware solution runs multiple detection engines, another provides a feature for managing Public Key Infrastructure encryption. But the PKI features really need Enterprise-level support, the virus/spyware protection isn’t top-notch, and the firewall manages to be both obtrusive and ineffective. Not only that, the suite seriously slows system boot time and Web browsing. Consumers want a suite that does the job quietly and without generating problems-this isn’t it.

Comodo added virus and spyware protection to its existing Comodo Firewall Pro-thus was born Comodo Internet Security 3.5, a minimalist suite that doesn’t include antispam, privacy protection or parental control components. It does have the virtue of being free, though. But while the firewall module is admirable, the added virus/spyware protection just doesn’t do the job. The product scored dismally in my malware-removal test, did a poor job of keeping malware out of a clean system, and popped up multiple alerts for many perfectly valid programs. And it had more impact on system performance than I expected for such a lightweight suite. If you need free security, use the Comodo firewall and get your virus and spyware protection elsewhere.

CA (formerly Computer Associates) isn’t new to the security-suite market, but its latest version is significantly changed. Unfortunately, the changes in CA Internet Security Suite Plus 2009 went in the wrong direction. The software is weak in almost every area. Its completely separate virus and spyware scanners scored poorly both at malware removal and at keeping rogue software out of a clean system-only Comodo scored lower. The firewall resists malware attacks but bothers the user with many queries; with its Safeguard features enabled it seriously interferes with many valid programs. This pieced-together collection of security elements offers so-so protection while putting more of a drag on system performance than any other suite I’ve tested

Click here to compare the security suites featured in this roundup

=====================================

My Note: Well there you have it. This year at least I don’t have to run out and buy new Security Software, I use Trend Micro which is ranked second. -jschulmansr

=====================================

Gold and Oil Top Peter Grandich’s Shopping List – Seeking Alpha

Source: The Gold Report

Peter Grandich, creator and producer of The Grandich Letter for a quarter century, allied himself with AGORACOM in October, bringing his well-known and oft-quoted commentaries to a far wider audience than his subscriber base and financial media such as The Wall Street Journal, MarketWatch, CNN, GlobeInvestor, Financial Post and BNN. Breaking away briefly from his recent blogging, the veteran Wall Street watcher and investment advisor tells The Gold Report readers what he likes looking forward—gold (up to $1,000) and oil (between $35 and $40). Also high on his list: uranium (for the nuclear renaissance), junior miners (a select few), and Canadian banks (pretty much all of them).

The Gold Report: Judging from opinions you’ve expressed in recent newsletters and blogs, you clearly believe we will be testing the November lows during the first quarter this year. What is some of the logic behind why you think that will happen?

Peter Grandich: My belief has been that if and when the U.S. stock market bottoms, along with the economy, it will be an L-shaped bottom, not the V that so many on Wall Street keep talking about. The problems that brought us here persist. In fact, they’ve gotten worse over time, which gives me even more reason to believe that we’re going to bottom eventually but not go far off that bottom once we do. The logical viewpoint for us to take at this point is to look for a market to make at least a double bottom, if you don’t believe it’s a V bottom. Obviously, if it’s a V, you only have one time you’re at that low.

The November lows are, I suspect—as I’ve said recently—are not a question of “if” but “when.” A strong bounce is likely to come off that because the remaining bulls who aren’t totally bloodied would look and hope for that to be an opportunity to get more long if they’re not already 100% long.

The view we’ll have to take after that is watch the bounce, see what type of volume and breadth it has. The problem with rallies we’ve had all through this decline is that neither their volume nor breadth has been half as strong as in the declines; that is always an earmark that the bear market is continuing and that rally is a countertrend. So that’s another thing to look for when and if we catch those lows.

TGR: You mentioned that maybe we should be looking for a double bottom. If we go back and re-test the November lows, is that our double bottom? Or would you expect to go through the November low?

PG: I still suspect we’re going to go through it, but we have to be able to change our views as the markets change. The only way bouncing off that bottom and then turning up past 9000 on the Dow—that would be the only technical factor that would suggest to me that the bear market was over. My feeling is that even if we do hold that November low, we are going to have a very long trading range on the Dow of somewhere between 7500 and the 9000 that we rallied to twice the last year but have failed to go through.

Rather than trying to catch a falling sword and usually getting their hands sliced by it, quite frankly I think what’s best for investors would be to be certain or fairly certain that a bottom is put in and miss the first 10% or 20% to the upside. I think if and when we do break out above those numbers, we’ll also be hearing things on the economic side getting better.

Now, that’s not my bet right now, but I think you always have to have a plan to possibly change your view and be set for it if certain things happen. My most likely scenario continues to be that this economy will be very weak throughout 2009, and not just the first half that the bulls keep talking about. And we don’t have any real hope of a sustained equity bull market at least until 2010 at the earliest.

TGR: Your writing is bullish on oil, though.

PG: Yes. We suggest that people contain any oil purchases between $35 and $40—not above $40 at this point. Oil longer term is far more likely to be higher than that level than equities looking out the same timeframe. If people are still willing to look out three to five years versus three to five days, I think oil is a better risk-reward at this point than the U.S. equity market.

TGR: Are you talking about buying oil as a commodity or purchasing oil equities?

PG: Both. What I do like especially about Exchange Traded Funds now is the ability to have a bunch of oil stocks within them. No-load funds are still a good way to go with equities for those who are very long-term oriented. But ETFs are a better vehicle for investors because you can buy and sell as many times as you want during the day, not just get the end-of-the-day price when you sell your mutual fund. Both are useful. But either way, I think you need to track the actual commodity as well as oil stocks.

TGR: Your blogging suggests that you think precious metals sector also will do well, even in 2009?

PG: Yes, I continue to believe that; in fact, I believe the best investment right now is gold. Not because I think the world’s coming to an end; quite frankly it won’t matter if you have gold if there’s truly an end-of-the-world scenario. And I am not a gold bug; I’ve been bearish on it at times.

Nevertheless, thanks to the credit crisis, which is taking place in all four corners of the world, I do believe people around the globe are realizing that paper money may not be the best safe-haven investment. And although gold did not go up in 2008, it did serve its purpose by being an insurance hedge. Whether they’re professionals or just individual investors, no one I know would mind having been even for 2008 versus the heavy losses they took. So, gold did its job; those who put money in gold didn’t see the losses that everybody else suffered.

But I believe now that we’re going to see capital gains opportunities in gold for 2009 and into the foreseeable future. The market has all the fundamentals that one would want right now. There’s a declining supply, which will decline even further because those who normally look for gold, the junior resource stocks, have been so hammered that we’re not going to see a lot of new exploration for some time.

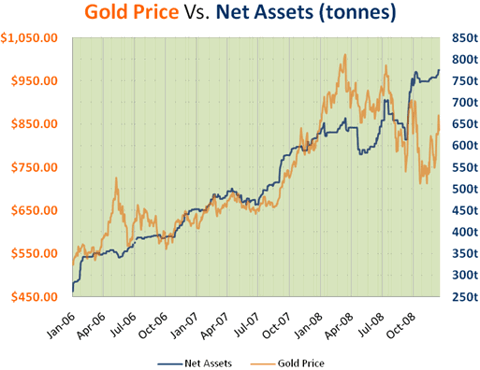

The few companies that will be going into production will be a premium. The excess supply that used to come into the market, particularly from central banks, has dried up. We’re also seeing tremendous physical demand; in fact, throughout 2008, it was very difficult for people to acquire physical gold. Coins and bars that used to be readily available were in such demand that there became a shortage. In fact, if you wanted to purchase physical bullion, you were paying 10% or more above the spot price.

People say that should have caused a dramatic rise in the gold price. The paper market is still driven by the COMEX, where the futures trade. Unfortunately, some people claim, that market has been manipulated. I can simply say that the paper market has not mirrored the physical market. I believe the physical demand eventually will overrun what is not happening in the paper market. Once that occurs and once we’re above a $1,000 and stay there for more than a week or a month, I think we’re going to see a lot more money pour into gold. I don’t know about $2,000 an ounce for gold, but once that money starts to pour in I still think $1,200 gold and $1,400 gold— even $1,500—is a very variable, useful and likely target.

TGR: For 2009?

PG: More likely in 2010. The only way I see it happening in 2009 is if we really see worse economic conditions and financial Armageddon. Right now thanks to this historical presidential election in the U.S., there is a mild—if misplaced—hopefulness that somehow the new administration can magically do something in a week or a month or a couple of months that the group before couldn’t do in several months, if not years. Once this hopefulness wears off and people realize they face the same difficulties in fixing a horrendous problem, we could see even more pressure in the credit market and in the equity market. If that’s the case, money has to go somewhere.

What’s been most interesting, a couple of weeks back, the Treasury market—where most people ran to in the last downturn—actually started selling off, especially on the longer end. I think part of that money is going to find the gold market.

TGR: Are you looking at gold as a precious metals purchase as in physical gold or ETFs? Or in this case do you see plays to be made in equity shares?

PG: There are equity plays to be made. I think first you want to have some physical bullion. One of the things I learned as a hard lesson—and as many other people did in 2008—sometimes mining shares, particularly the juniors, don’t track gold. During a large-scale liquidity crisis, people sell everything they own, including juniors. Even so, I think we’ve seen the industry destroyed as much as it possibly can be. The companies that have managed to stay around, particularly those that are going into production soon or are already in production, will have a big bounce back. Unfortunately, many of the pure exploration companies that haven’t come close to identifying a mine may not survive—but those failures actually enhance the prospects of the survivors. Money will flow into them long before it flows into the small exploration companies.

TGR: Do you have any favorites as you’re looking at these near-producing or producing companies?

PG: Sure. In fact, we’ve just been engaged by Hawthorne Gold Corp. [TSX.V:HGC] to help with corporate development services. I have to point out that I have a prejudice there simply because I’ve been aware of the management team for years. When I was a fund manager and a hedge fund manager, I purchased and did very well with the companies they were involved with. I am speaking of El Dorado Gold Corporation (EGO) and Bema Gold. Both principals at Hawthorne Gold were founders of those previous companies and helped develop mines. Hawthorne Gold has made a series of acquisitions and is going into production, apparently in 2009. As I said earlier, those are the types of companies that I think are going to be attractive first and are likely to see a big rebound, even though they have suffered in seeing their share price decline.

And Hawthorne has the management team, has the finances, and is mining in an area of the world where they don’t have to worry about political problems. British Columbia, most of Canada, and even the U.S. are probably the safest places to explore and mine right now. And, of course, that’s where they’re concentrated on. So they seem to have all the ducks in order and have the ability to prosper at the expense of some others who are not in the position that they are.

TGR: A big focus now for people who are investing now in equities are the balance sheets, specifically cash in the bank and how long a company can survive without going to the capital markets. Can you speak a bit about that regarding these companies?

PG: There’s no question that financing has all dried up in every sector, and the junior market is no different. The good news is that El Dorado has been able to raise enough capital to see themselves through production. Once production starts, obviously cash flow becomes important. I believe we’ll see a lessening of that tightness in those companies that are looking particularly for gold or precious metals as their main focus because of the expectation that the gold price is going to rise and attract people’s eyes while everything else is seemingly not moving in the world.

So, I think if we look into the second half of 2009 and 2010 when companies like Hawthorne may need to come back to the market, I think the market will be more conducive to raising money than it has been or is now.

TGR: How was El Dorado able to raise money to go through production?

PG: Both Mike Beley and Richard Barclay were senior managers and directors at El Dorado in its early days. (Both Beley and Barclay are Hawthorne Directors; Beley is also Chairman, while Barclay is also President and CEO.) They helped raise a lot of money and bring mines into production. They also were able to do the same thing with Bema, which Kinross Gold Corporation (KGC) eventually bought for something like $3 billion.

When financiers look at companies, they’ve learned that the real important thing in juniors is management. Metals mining has a few different ways to go at it and all, but it’s not very exotic. So the likelihood of seeing their monies do well is really going to fall on the management team’s shoulders. It stands out when you have a management team that has demonstrated at least once—and these gentlemen have done it twice—the ability to develop a company and bring it into production. And let’s not forget that for every little junior that looks for metals and goes into production, 95 or so don’t go the whole nine yards. That stands out. That is always what impressed me about these gentlemen, why I used to be involved, and put money in El Dorado and Bema, and why I would want to associate with their company now. They are clearly standouts as managers in an industry where failure is the norm.

TGR: What do you think about Bravo Venture Group [TSX.V:BVG]?

PG: There is another company that’s made just outstanding discoveries and demonstrated an understanding of the deposits. They continue to put out great drill results—excellent results of deposits that are developing very nicely. And also, it’s a company with the ability to demonstrate that they have enough support out there despite terrible financing conditions. They’ve been able to complete a financing recently that is going to move them forward. And they’re in a very good area of the world; as I said earlier, Canada and America are the safest places to look right now. So Bravo Ventures, too, I believe is one of the companies that will move forward to production. I suspect that they may not want to run the production, though, so there may be a sale or some type of a joint venture.

TGR: How about Bravo’s management team?

PG: Really what got me interested is somebody I worked with in the past and offered me an opportunity to do so again. As I said, I make my bets on management, and even some great management teams still don’t go all nine yards. But just like the quarterback is the most important position on a football team, management is in juniors. I go a long way back with Robert Swenarchuk, who’s head of Bravo’s Corporate Development and a member of Board of Directors. He is the one who made me interested in this and showed me why this deposit could develop. He was right. I’m a people better, and especially in the junior markets, and there again is another reason—because I have such faith in somebody who has an active role in the company.

TGR: You also follow ATW Gold Corp. [TSX.V:ATW].

PG: Just like you find out who your real friends are during tough times, you learn which people really know what they’re doing during tough times. It was easy when everything was flying; even the pigs were flying. ATW was able to secure a very advanced-stage mine that its previous owners had to liquidate because they had financial problems, and then brought in a very top-line management team that had experience in that area. On top of that, several months ago they switched their currency from Australian dollars to Canadian dollars. So they used the currency situation to make a gain of almost $1.5 million and at the same time avoid having to go the market and advance their project.

Here, too, is management. I’ve known Graham Harris, one of ATW’s Directors, for almost 20 years. He’s always been a straight shooter, particularly when he was in the financial arena, and finding a straight shooter in the financial arena is like finding a needle in a haystack. So I’ve always had confidence in his honesty. He was very excited about this project. He brought me in about a year ago; it just keeps being advanced. We should be in production there in short order. If you notice, I’m trying to concentrate on companies that are either close to going into production or are in production now.

And there again, in my opinion, they are going to be a survivor of the juniors’ dismay and then be there when the market eventually rebounds and comes into a bull market again. They will be among the leaders in the juniors segment.

TGR: Do you have any other companies under that umbrella?

PG: My favorite, favorite company—and it is my largest personal holding so I speak from a biased standpoint—is Northern Dynasty Minerals Ltd. (NAK). It has the largest undeveloped copper-gold deposit in the world. It’s in Alaska. The numbers are crazy—94 million ounces of gold, 72 billion pounds of copper. It is currently in a venture with Anglo Gold (AU) where Anglo can purchase 50% of the project by spending up to $1.4 billion. They’ve already spent a couple hundred million in further developing the project and advancing it to a pre-feasibility study.

It also has a 19.9% ownership by Rio Tinto (RTP). It had a 10% ownership by Mitsubishi, but Mitsubishi has been buying shares continuously in the open market lately. I suspect they’re heading to 19.9% ownership too.

If and when the market returns to people interested in precious metals or even base metals, there’s no question that at least one of those companies will want to own at least half, if not the whole deposit. Northern Dynasty’s stock came down a lot because all stocks came down. It is ridiculously priced at few dollars a share, but I believe when this eventually is done it will sell for multiples of where it is now.

TGR: Why wouldn’t Anglo buy it now while the price is depressed?

PG: Like everybody else, they don’t think time is against them. They realize this is a bear market. They also realize that they’re going to need current management’s support. Current management has about 20% of the stock; and as I said, their opposition—which are competitors—Rio has almost 20%. So unless they made a very favorably valued price, they’re not going to be able to buy it at current prices or anything close to that.

Hunter Dickinson, which manages this Northern Dynasty, is one of the biggest players in the junior- to-mid-size producers and exploration companies. They know they have to work with all these potential bidders; so they have not really played one against another—but sooner or later it will be one against another. So no one is rushing to drive the price up, but if Mitsubishi is able to acquire 20%, and Rio and management have 20% each, if and when a bidding war starts, there’s only about a 40% float out there. That will be when we really prosper as a shareholder. You need to sit back and accumulate a stock like this now and go on that expectation of what I said turns out be true.

TGR: So, how close is Northern Dynasty to production?

PG: It’s approaching pre-feasibility. We won’t see production for a few more years at least, but it’s so large. It’s 25% of the copper needs for the United States, and it’s on the top of every major producer’s list. We could still see someone else come out from left field that currently doesn’t have a position, but the ones I’ve mentioned certainly have the lead in potentially acquiring the additional stake. The problem for all three of them is that they know they can’t make a low-ball bid, but when they do make a bid for it, they want a bid that’s not going to cause a battle. Since nothing is moving now, they’re just waiting until someone else makes the first move. That’s the difficult part, but you have to speculate that eventually someone will. And when they do you’re going to get a multiple return on what you’re paying for it now.

TGR: In a worldwide recession, given the price of copper, wouldn’t the copper component discount the gold?

PG: The beauty of having so many million ounces of gold is that you can sell the copper for whatever you get, and you get the gold for almost nothing. It’s such a huge deposit; it’s been described that they still will not find the whole deposit by the time our grandchildren are adults. That’s how huge it is. We’re all living on the expectation that someday things will get better than they are now. If and when they do, the demand for the metal will come back again.

There’s an interesting thing about the base metals and even copper. Despite a tremendous slowdown in the world, copper has managed to still be about twice the price it was at the lows of the last big recessions in the ’80s and ’90s. One of the reasons I think that has happened is that most of the major, highly valued deposits had been discovered and drilled off. So one of the reasons copper is not dropping so much is because the operational costs to develop copper is higher than it was several years ago. We’re probably within 10% or 15% of that absolute bottom. It doesn’t mean you start buying now, because it may be a while before it can raise its head. But we’re closer to the end of the decline in copper than we are in the U.S. stock market.

And I must make the point that even if and when I become bullish on equities again, someone is going to have to be over-weighted in foreign stocks. One of the first things I’m looking to do once I believe markets have bottomed is to buy Canadian banks.

TGR: What is it you like about the Canadian banks?

PG: Of all the banking systems around the world, the Canadian banks (outside of Toronto Dominion (TD)) is the only group of banks that didn’t get heavily involved in all the CDS markets and all these derivatives. So the Canadian banking system is one of the places I think will be fairly safe to enter once the equity market has bottomed. They’re on my shopping list right now to eventually look at, but I think they will continue to decline somewhat until the markets themselves bottom.

TGR: One of your blogs suggests that uranium has bottomed out and we’re going to see it up in triple digits in 24 to 36 months. What about this year?

PG: I don’t know so much about the price in 2009. Uranium has seen its worst days in my view. I do believe we’ve seen the bottom and I believe it can tick up. The real factor will be how much the new U.S. administration is truly going to look at alternative energy. It’s one thing to say it during a campaign, but how much will Obama turn to alternative energy? When oil was hitting $140 and $150 and Congress was hauling in the principals of oil companies at $150, they can’t haul them in any more at $40. So I don’t know if they’re going to do what so many other administrations have done—and that is to kick the can down the road and let somebody else worry about energy concerns.

That said, it seems to be a serious concern of the current administration, and I think people will realize when all is said and done that the most efficient and effective and perhaps fastest way to increase abilities of getting energy outside of fossil fuels is nuclear energy. And it’s certainly happening around the world. Therefore, I think the uranium price will work its way higher, and I also think it’s only a question of when we’re going to see more nuclear plants built in the United States. Not so long ago, people thought we’d never see that.

A Bronx native, Peter Grandich hit Wall Street 25 years ago after starting an investors’ club while working as a warehouse manager and launching his now-famous publication, The Grandich Letter, which grew to become a leading newsletter analyzing the metals and mining sectors within global stock and bond markets. After only three years on Wall Street, Peter was Vice President of Investment Strategy for Philips, Appel and Walden, a top New York Stock Exchange member firm. He was dubbed “the Wall Street Whiz Kid” after he forecast the 1987 stock market crash weeks before it happened. He then predicted that the market would reach a new all-time high within two years. It did. He said that 2000 would see the end of great mega bull market of the ’80s and ’90s. It was. As long ago as 2001, he thought U.S. banks had gone “overboard in making loans that required near-perfect economic conditions in order to avoid substantial bankruptcies” and expressed concern that some of them “seem to have hidden their problems from the average investor.” In October 2007, he warned investors to “man your battle stations” and prepare for the “unprecedented economic tsunami” that would hit America beginning in 2008. Jay Taylor (Gold, Energy & Technology Stocks newsletter publisher) considers Peter “most remarkable for a successful Wall Street pro…unashamedly independent and outspoken about his views, which frequently are anything but politically correct.”

====================================

===================================

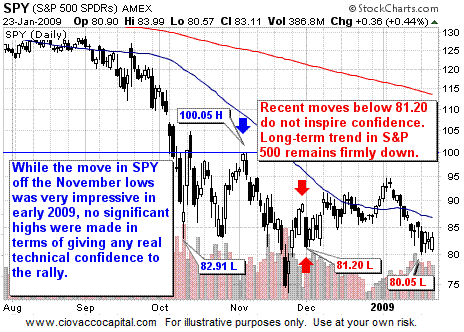

U.S. Stocks: Downtrend Remains In Place

U.S. Stocks: Downtrend Remains In Place Recent weakness in the S&P 500 Index leaves open the possibility that we will revisit the November 2008 lows around 740 (intraday). If those lows do not hold, a move back toward 600 becomes quite possible. On Friday (1/23/09) the S&P 500 closed at 832. A drop back to 740 is a loss of 11%. A move back to 600 would be a drop of 28%. These figures along with the current downtrend highlight the importance of principal protection and hedging strategies.

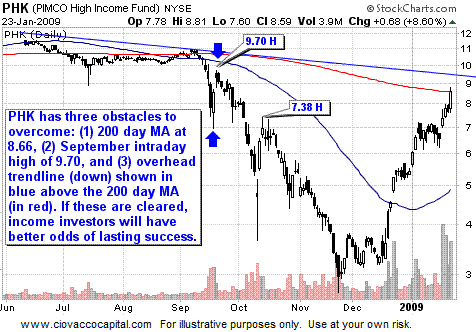

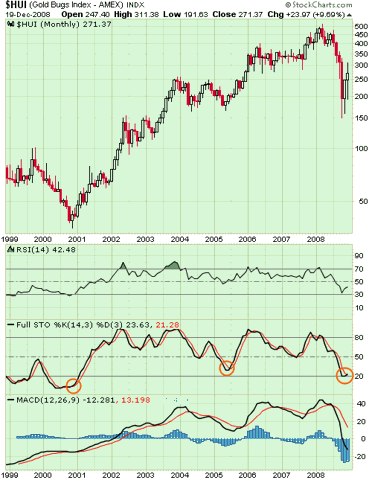

Recent weakness in the S&P 500 Index leaves open the possibility that we will revisit the November 2008 lows around 740 (intraday). If those lows do not hold, a move back toward 600 becomes quite possible. On Friday (1/23/09) the S&P 500 closed at 832. A drop back to 740 is a loss of 11%. A move back to 600 would be a drop of 28%. These figures along with the current downtrend highlight the importance of principal protection and hedging strategies.  Gold & Gold Stocks Still Face Hurdles

Gold & Gold Stocks Still Face Hurdles

Run In Treasuries Is Long In The Tooth

Run In Treasuries Is Long In The Tooth

Strength In Bonds Shows Little Fear of Price Inflation

Strength In Bonds Shows Little Fear of Price Inflation

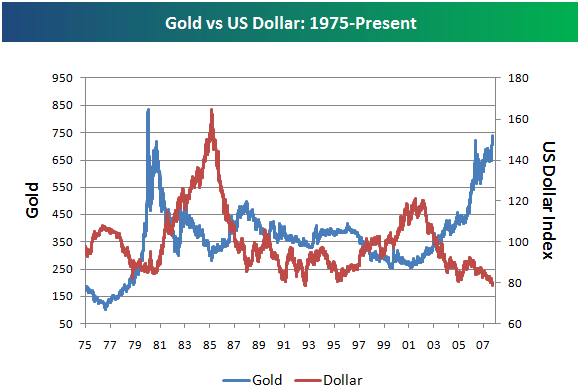

U.S. Dollar Remains Firm

U.S. Dollar Remains Firm

October. Still, investors can tap into non-financial bonds like

October. Still, investors can tap into non-financial bonds like  assures dollar destruction because the Fed is now on course to print money like never before to quash deflation. We all better hope and prey that the Fed can drain excess bank liquidity very quickly when this credit crisis ends. If not, we’ll have some serious inflation – much worse than what we saw prior to July 2008.

assures dollar destruction because the Fed is now on course to print money like never before to quash deflation. We all better hope and prey that the Fed can drain excess bank liquidity very quickly when this credit crisis ends. If not, we’ll have some serious inflation – much worse than what we saw prior to July 2008.

A private investigator has released to WND

A private investigator has released to WND