Tags

ANV, Austrian school, AUY, Bailout News, banking crisis, banks, bear market, Bollinger Bands Saudi Arabia, bonds, Brian Tang, bull market, CDE, CEF, central banks, China, cobalt, Comex, commodities, Copper, crash, Currencies, currency, Currency and Currencies, deflation, Dennis Gartman, depression, DGP, dollar denominated, dollar denominated investments, Doug Casey, economic, economic trends, economy, EGO, Federal Deficit, financial, Forex, FRG, futures, futures markets, gata, GDX, geothermal, GG, GLD, gold, Gold Bullion, Gold Investments, gold miners, Gold Price Manipulation, Green Energy, GTU, hard assets, HL, hyper-inflation, IAU, India, inflation, investments, Jeffrey Nichols, Jim Rogers, John Embry, Jschulmansr, Keith Fitz-Gerald, majors, Marc Faber, market crash, Markets, Michael Zielinski, mid-tier, mining companies, monetization, Moving Averages, NAK, NGC, NXG, PAL, palladium, Peter Grandich, Peter Schiff, physical gold, platinum, platinum miners, power, precious metals, price, price manipulation, prices, producers, production, protection, recession, risk, run on banks, safety, Sean Rakhimov, silver, silver miners, SLW, small caps, sovereign, spot, spot price, stagflation, SWC, Technical Analysis, TIPS, U.S., U.S. Dollar, volatility, warrants, XAU

Ahh the sweet smell of recovery! It’s “official Bernanke said so and so did MSNBC. I don’t think we are anywhere close to being out of the woods yet. To many shoes still dropping. Mortgage Resets, Commercial Real Estate, the number of banks failing each month, and the U.S. Dollar; just to name a few. Oops, can’t forget Inflation, oops hyper-inflation. Hey, we haven’t even gotten to the world political climate; i.e. Iran, N. Korea, Israel, and Afghanistan; to name a few more. Where are the contrarians? What happened to astute investing? When is Geitner going to turn off the printing press? When is China going to fire back in the trade war and just say no to one of the next treasury auctions? If that happened for 1-2 auctions how do you think the market will react? Personally, I think we are dead in the eye of the hurricane of economic malestrom. I remember reading early this year this is the exact blueprint of the Bilderberger Plan, allow the stock market to get to pre-crash levels, suck in all the investors back into the market and then pull the plug. I am not wearing a tin foil hat either… research this out for yourself (Google Bilderberger’s and another good source is Alex Jones Infowar site.) I also find it very interesting no news from the latest G-20 meeting. Plus the BRIC countries are very silent, can you imagine if China convinced those countries to side with them in a trade war? Don’t get me wrong I want to be out of the recession too. However, when everyone is saying Buy, it is usually the time to Sell. I think the DJI still has more room 9750 is the first major resistance, next 9850, and then no man’s land at 10,000 and above. I don’t think we will quite get there (DJI 10,000), but since we are in the head building phase of the head and shoulders formation on the charts it could conceivably happen. So since there are some good stocks still out there, due due diligence, keep your stops tight within 10-18%. I know I would rather take 60-80% off the table in profits than ride the elevator back down.

Gold for the 3rd day has held above $1000, it doesn’t surprise me. Okay we now have support at $998-$1000 for gold. The first resistance is te $1011 double top, when that falls, next stop $1020, and then the assault on the all time high of $1033. Silver already is at it’s high for the year and the sky is the limit. First of all with the euphoria over the “recession is over gang” will mean a perceived and partially real rnewed industrial demand for both Silver and Copper too.. However, when Gold takes out it’s all time high, I think there will be a massive influx of money into Silver the “Poor Man’s Gold”. Silver at $25oz before the end of the year and Gold at $1250- $1325. I have been accumulating both and also own the core major Silver and Gold producers. I have have mid-tier and junior producers and a few good ‘explorer’s too! This is not to “toot my horn”, but to implore you to join me. Get in now, and hang on for the ride of your life! Great Investing! – jschulmansr

Follow Me on Twitter and be notified whenever I make a new post!

twitter: http://twitter.com/jschulmansr

twitter: http://twitter.com/TweetsTheCash

twitter: http://twitter.com/DareSomething

LinkedIn: http://linkedin.com/in/jschulmansr

FaceBook: http://facebook.com/jschulmansr

===================================================

Claim a gram of FREE GOLD today, plus a special 18-page PDF report;

Exposed! Five Myths of the Gold Market and find out:

- · Who’s been driving this record bull-run in gold?

- · What Happens When Inflation Kicks In?

- · Why most investors are WRONG about gold…

- · When and How to buy gold — at low cost with no hassle!

Get this in-depth report now, plus a gram of free gold, at BullionVault

===================================================

Wednesday Outlook: No Speed Bumps in Sight? – Seeking Alpha

September 15, 2009

NO SPEED BUMPS IN SIGHT?

This rally has only modest volume (although more today) and positive major news remains thin but always “better than expected” (Retail Sales and Empire State Manufacturing Survey). But, hey, Bernanke postulates that the recession is “likely over.” Now, who the hell knew that?! Geithner was more equivocal in his comments saying a “true recovery still has a ways to go.” Well, okay, let’s just say things are better than before.

Volume increased on an up day for a change but some of this is misleading given one glance at the late day trading on the 5 minute SPY chart. Breadth however was positive but not overwhelmingly so.

“Today is the last trading day for VIX SEPT options, with the cash settlement price disseminated tomorrow morning off the CBOE SPX option volatility calculation. The open interest in the SEPT 25 puts is a staggering 188k, watch for the underlying to lift higher and migrate to this strike during the course of the trading session. Dealers are long this strike due to a series of put butterflies (SEPT 22.5,25,27.5) purchased by customers the past 10 days.” This per our friend, Scott Larison, Managing Director, Options Sales and Strategy, Forefront Advisory in New York.

Retail Sales were “better than expected” causing true believers in Chucky, the Consumer you can’t kill, to go on another shopping spree. You were out there shopping right?

We have quad-witching ahead and some of today’s action is no doubt linked to getting out of the way and manipulation with options and futures. This evening expiring September S&P futures are down a lot with rollover to December no doubt occurring. These are the types of the things that HAL 9000s live on.

There’s plenty of momentum for bulls and there are times this does seem unstoppable. Funny thing, sometimes this is just when things get upended.

One thing markets like is Washington gridlock and the most overexposed president in history is helping with it. He might do a little better if he gave us and his teleprompter a break. That’s just my opinion.

Let’s see what happens.

You can follow ETF Digest on twitter here.

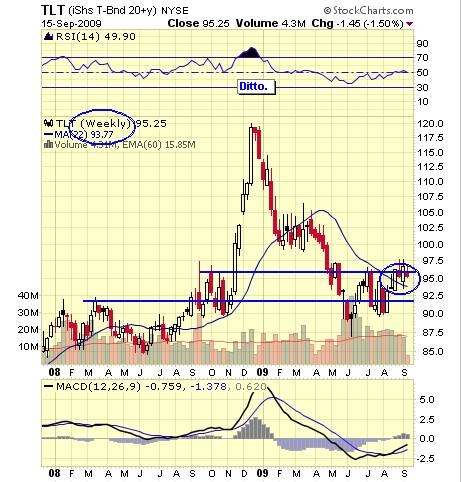

Disclaimer: Among other issues the ETF Digest maintains positions in XLB, XLI, IYR, IEF, TLT, UDN, GLD, DBC, XLE, EWJ, EWZ, EWC and RSX.

The charts and comments are only the author’s view of market activity and aren’t recommendations to buy or sell any security. Market sectors and related ETFs are selected based on his opinion as to their importance in providing the viewer a comprehensive summary of market conditions for the featured period. Chart annotations aren’t predictive of any future market action rather they only demonstrate the author’s opinion as to a range of possibilities going forward. More detailed information, including actionable alerts, are available to subscribers at www.etfdigest.com.

=====================================================================

– Trend Analysis Revealed –

Substantial moves like the ones that we have recently witnessed present opportunities to succeed or fail in the markets. Traders who stayed on the correct side of the trend were rewarded substantially.

Serious questions effecting your portfolio still remain:

– Have we seen the Indexes bottom or top?

– Is a reversal in the near future?

– Is it too late to go short?

Stay on the correct side of the market. Let our Trade Triangle technology work for you. It’s free, It’s informative, It’s on the money.

Free Instant Analysis delivered to your email inbox. Analyze ANY Stock, Futures, or Forex symbol.

Click Here For Your Free Analysis

=============================================================================

Nothing in today’s post should be considered as an offer to buy or sell any securities or other investments; it is presented for informational purposes only. As a good investor, consult your Investment Advisor/s, Do Your Due Diligence, Read All Prospectus/s and related information carefully before you make any investing decisions and/or investments. – jschulmansr