Tags

Austrian school, Bailout News, banking crisis, banks, bear market, Bollinger Bands Saudi Arabia, bull market, central banks, China, Comex, commodities, Copper, Currencies, currency, deflation, Dennis Gartman, depression, dollar denominated, dollar denominated investments, economic, economic trends, economy, Federal Deficit, financial, Forex, futures, futures markets, gata, GDX, GLD, gold, gold miners, hard assets, hyper-inflation, India, inflation, investments, Jim Rogers, Keith Fitz-Gerald, majors, Marc Faber, market crash, Markets, mid-tier, mining companies, monetization, Moving Averages, palladium, Peter Grandich, Peter Schiff, physical gold, platinum, platinum miners, precious metals, price, price manipulation, prices, producers, production, protection, recession, risk, run on banks, safety, Sean Rakhimov, silver, silver miners, small caps, sovereign, spot, spot price, stagflation, Technical Analysis, TIPS, U.S., U.S. Dollar, volatility, warrants, XAU

It’s starting again, time to get aboard now, next stop $1000 to $1500! Gold cleared the $950 price mark today with a vengeance. During trading today Gold was up over $970 oz and closing at $967.50 up $25.30. Today’s main headline on MarketWatch was “Bears test November lows- Technical support levels in peril; Investors pile into Gold, Treasuries”. As I have mentioned in a recent post about Gold if we successfully clear and close above the $950 – $960 level the Gold will zoom up and have a retest of the all time highs! To answer my question I posted here… Gold has passed it’s first test with an A++. If you haven’t already invested in gold and precious metals you definitely need to do so now! Some of the following articles explain why… – Good Investing – jschulmansr

===========================

Here is where I buy my bullion:

================================

Don’t Kick Yourself Later for Not Buying Gold and Silver Now – Seeking Alpha

By: Peter Cooper of Arabian Money.net

Gold is powering up towards $1,000 an ounce, and while the odd hesitation along the way is possible it will shortly cross this boundary, hit a new all-time high and then head upwards again.

A trend is your friend, especially if you take advantage of it. For gold the question is how best to leverage the up trend.

Gold and silver stocks are the answer. Conveniently precious metal stocks got really thrashed last autumn – along with gold and silver and every other asset class except bonds. So they are dirt cheap.

Rising prices

But will gold and silver equities not fall again if global stock markets tank, as they surely must with profit forecasts for the non-financials still ludicrously optimistic (face facts, for many major companies there will be losses and not profits in 2009)?

No they will not if precious metal prices are rising – and not falling as they did last autumn. And why will gold and silver prices keep on rising this time?

Well, investors are now very worried about bonds and currency rates, and that leaves gold and silver as the last safe haven in the investment universe. If there is only one investment class left to buy that ought to simplify things for investors.

Rising profits

Gold and silver producers are also big beneficiaries of falling energy prices this year, as up to a quarter of production costs go on energy. In addition, most mines are in non-dollar economies, so manufacturers have costs in depreciated currencies and income in the strong dollar.

That means that even if precious metal prices stagnate – and that looks highly unlikely – gold and silver producers are among the only commodity producers that will see profits jump in 2009.

My blog contains many articles on gold and silver which can point you towards some of the better, and riskier equity investments in this sector, and taking a risk in a rising market usually pays off handsomely.

The people who will be kicking themselves later in the year will be those who do not buy gold and silver stocks now.

This reminds me of my warning to those who did not buy Dubai property when they first had the chance, and even after a 50 per cent fall in house prices they are still 300 per cent up on their original investment!

========================

My Note: If you have been following my Blog “Dare Something Worthy Today Too!”, for any length of time this is exactly what I have been saying – many gold and silver stocks with production are still selling at or near book values! -jschulmansr

========================

Gold Strikes Record Levels in Most Currencies – Seeking Alpha

By: Toni Straka of The Prudent Investor

With all equities markets deep in the red, MSM and bloggers have missed out on this easy scoop for several weeks: Gold currently strikes new all-time highs in most currencies. This sensational news, omitted in all those media that are normally quick to recommend this or that paper ‘asset’, which in the end is always only somebody else’s obligation, can be revealed at this blog exclusively, a Google news search shows. 😉

Gold traded for more than €771 and GBP 682 for the first time in history. The strong rise in the price of gold to new historic records in most countries except the USA is a logical reaction to the credit and solvency crisis that engulfs the globe as investors, nervous about a total market fallout, flee all paper promises and seek a truly safe haven.

Gold has never lost its value in more than 3,500 years, whereas no fiat currency survived longer than a human’s lifespan so far. Check out its resistance against inflation here.

GRAPH: Gold priced in Euro has been on a tear since late November. It also outpaced all other asset classes. Chart courtesy of Stockcharts.com

I have been recommending investments in gold and mining shares since 2005. Licking my wounds from last year’s biggest and longest decline in this equity sector in 80 years, I will at least have a story to tell to my grandchildren.

But the fundamental outlook has only worsened in the past 4 years. Having correctly called for a sharp economic downturn in the USA since 2005, I nevertheless failed to recognize the dramatic situation in the Eurozone and the recent hard landing of China. This worsening global situation only underscores the value of holding the only asset that is not someone else’s obligation. The Euro is as doomed as are Federal Reserve Notes and nobody outside the UK cares about Sterling anymore.

We are about to witness the era of busted major fiat currencies that will go out the same way as did all unbacked fiat curencies in the past 1,000 years.

The Chinese tried it in the 11th century and it ended in a revolt. The same happened in France in the 18th century where it gave birth to the Republic. The decline of the Austro-Hungarian empire in WWI came on the heels of hyper-inflation and Germany’s fate could have taken another turn in the 1920s, if it were not for the hyper-inflation that paved the way for Adolf Hitler.

Unfortunately, we could very well end up as happened in past crises, with everyone a millionaire beggar.

========================

Bullish Long Term Outlook for Gold – Seeking Alpha

By: Peter Degraaf of pdegraaf.com

The long-term outlook for gold is very bullish, for to paraphrase Sir Winston Churchill’s famous remark, “never before in history have so many dollars chased so few ounces of gold (and silver)”.* The mountains of currency are rising, while the number of ounces of gold produced by gold mines is dropping.

The passing of the Stimulus Bill, referred to by some as the Porkulus Bill, will add billions of dollars to an already ballooning deficit. Instead of allowing the excesses in the credit markets to work themselves out by letting healthy institutions prosper, while allowing unhealthy institutions to fail, the new administration, aided by Congress, is throwing gasoline at the fire by rewarding shoddy business practices. People like Barney Frank and Christopher Dodd, who strong-armed the banking industry to make questionable mortgage loans, are now helping to shape the decisions that will prolong the problems. The foxes are still in the henhouse.

In the 1960’s it was James U. Blanchard III who pointed to the growing US deficits as the trigger that would cause gold prices to rise. In those days the deficits were still counted in millions of dollars. One wonders what Jim would say about deficits that are now counted in trillions of dollars. His advice would surely be: “Buy Gold”.

It was my pleasure to meet Jim Blanchard at one of his hard money conferences in New Orleans. Jim founded the National Committee to legalize the ownership of gold in the USA. In 1973, during the inauguration of President Nixon, Jim hired a small plane that flew near the inauguration site towing a banner that read: “Legalize Gold”.

Jim did everything with style and ingenuity. During one of his conferences he needed to move about one thousand of us from the convention hotel to a nearby convention center. He hired a marching band, and while police controlled several intersections the marching band led us to the center.

Let’s now look at some charts.

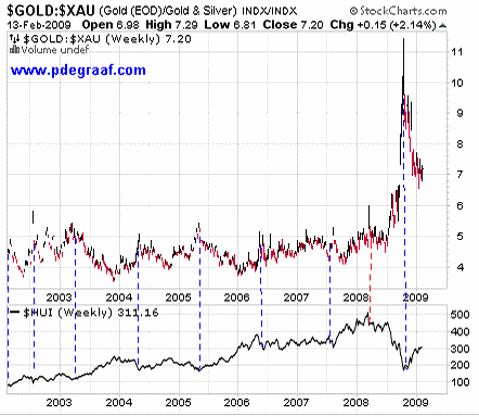

Featured is the chart (courtesy www.stockcharts.com that compares the price of gold to the XAU index (top), and compares this picture to the HUI index (bottom). The blue vertical lines draw your attention to a ‘link’ when the Gold/XAU rises above 5 and the HUI index begins a multi-month rise from a bottom. The red vertical line points to the only exception to this trend, since 2002. In that last seven years this early warning signal has worked 7 out of 8 times.

The last link is the ‘mother of all signals’, as the index rose to a record high of 11.5, while the Huey put in a four year bottom.

According to research done by John Hussman, in the past, when the gold/XAU ratio reached a point above 5, while the ISM purchasing managers index registers a reading below 50 (indicating the US manufacturing sector is decreasing), gold shares advanced at an annual rate of 125%. The current reading for the PMI is 35.6%, while the gold/XAU is at 7.2.

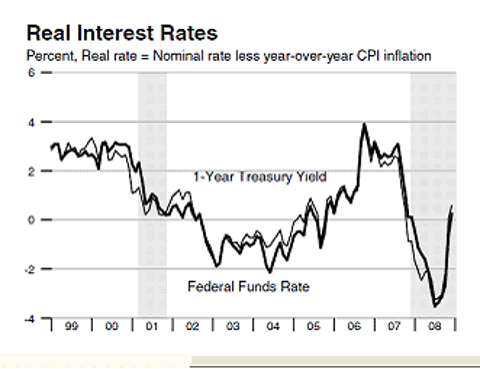

Featured is the ‘real interest rate’ chart, as reported by the Federal Reserve Bank of St. Louis. The bank shows the real rate at zero percent, having risen up from -3%. If we use the figures supplied by John Williams (see next chart), we arrive at a negative ‘real interest rate’ of -3.5%. Unless and until real rates turn positive by at least 2%, and for at least 6 months, we can depend on gold continuing its bull market rise.

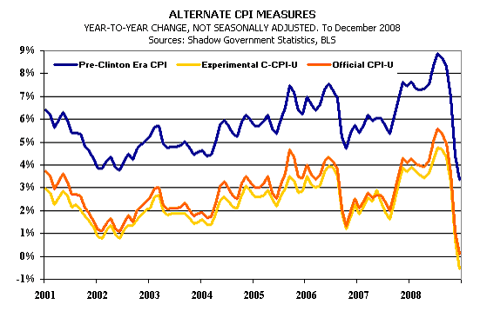

This chart courtesy www.shadowstats.com compares the official CPI rate in orange to the John Williams interpretation in blue. With the Williams CPI-U at 3.5% and short-term bills at 0% interest, the ‘real interest rates’ are negative by 3.5%.

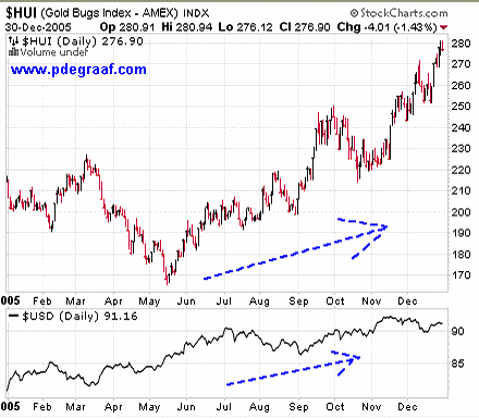

Featured is a chart (courtesy www.stockcharts.com) that compares the HUI index to the US dollar for the year 2005. For those who feel that gold stocks cannot rise unless the US dollar falls, this chart tells us that both gold stocks and the US dollar ended the year higher than at the start of the year.

As long as other currencies, such as the Euro, Yen, Pound and Canadian dollar are having problems of their own (caused by monetary inflation), the US dollar does not need fall, and gold and gold stocks can still rise.

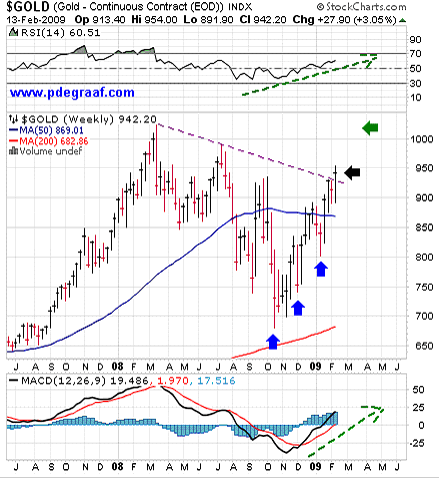

Featured is the weekly gold chart (courtesy www.stockcharts.com). The blue arrows point to bottoms in the 7 – 8 week gold cycle. The last 3 cycles were short, thus the expectation is that we are due for a longer one, perhaps 9 or 10 weeks. The black arrow points to the upside breakout that occurred last week. This breakout came from beneath resistance that went back all the way to March 2008 AD. The green arrow points to the target for this breakout. The supporting indicators (RSI & MACD) are positive, with room on the upside.

The Gold Direction Indicator moved up from a reading of + 20% on Feb. 9th, when gold bullion was 895.00, to the current reading of +60% with gold bullion at 941.00.

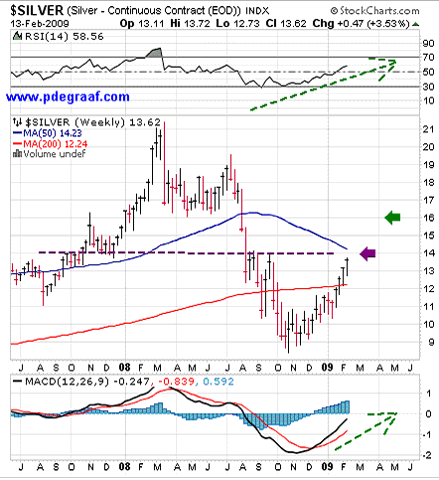

Featured is the weekly silver chart (courtesy www.stockcharts.com) . Price has risen four weeks in a row and is expected to meet resistance at the purple arrow. Once this resistance is overcome, the target is at the green arrow. The supporting indicators, (RSI & MACD), are positive with room to rise.

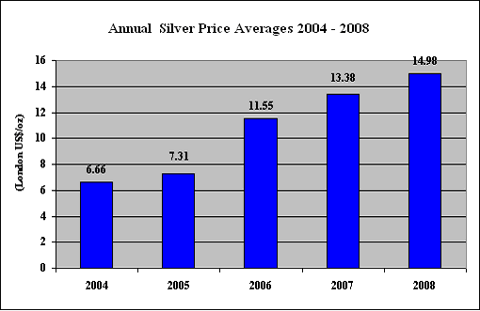

Featured is the price progression for silver during the past five years (annual average – data supplied by the Silver Institute).

Summary: Last week’s breakout by the gold price confirms that the Christmas rally that started in November is ongoing. In the short-term we can expect a lot of volatility, as commercial traders and bullion banks that are ‘short’ gold will do their utmost to suppress the price. They will do this by testing the current breakout. They will use the threat of ‘asset deflation’ (which has nothing to do with the effects of monetary inflation, which always leads to price inflation), and they will use the threat of IMF gold sales to try to cap the gold price rallies.

In the longer term the huge increases in currency (both paper and digital), on a worldwide basis, tell us that the gold bull still has a lot of running room left.

*(“Never in the field of human conflict was so much owed by so many to so few” – Sir Winston Churchill referring to the Battle of Britain).

DISCLAIMER: Please do your own due diligence. I am NOT responsible for your trading decisions.- P. Degraaf

========================

===============================

Upwrds momentum builds as gold breaches $950 – MineWeb

Source: MineWeb.com

Upwards momentum builds as

gold breaches $950

The gold price this morning moved quickly through the psychological $950 an ounce level and predictions of $1000 gold being seen sooner rather than later seem far from far-fetched.

Author: Lawrence Williams

Posted: Tuesday , 17 Feb 2009

LONDON –

In what has been a relatively steady climb over the past few weeks, gold moved back well above the psychological $950 an ounce mark in this morning’s trading (over $960 at the time of writing) – the first time in seven months it has achieved this level – while silver was approaching $14 an ounce, being pulled upwards by the gold price. Platinum and palladium were also better as platinum maintained its differential price advantage over gold.

Indeed gold looked poised to move higher still with ETF inflows continuing and a glimmer of renewed demand interest in India as sentiment may be moving towards a growing feeling that the price is poised to increase further. Previously India, the world’s largest area of consumption, has seen gold sales and imports at their lowest level for some time with traders anticipating lower prices. Today, though, the gold price in rupees hit a new record at over 15,000 rupees per 10 grams and there has been wide expectation of the price moving to 16,000 rupees in the short term with open interest in metal for April increasing a little.

In the Far East in general there appears to be a movement into gold developing strongly as the stock market continues to drift downwards. The market has seen the dollar price gold consolidating above $930 of late and there has been a strong feeling that the metal is poised to move higher which is now turning into real purchases and becoming reality.

Bloomberg reports that there is also talk of Central Banks buying gold rather than selling . The newswire quotes Steven Zhu of Shanghai Tonglian Futures Co. as saying “There’s been a lot of talk about central banks buying but they are quiet about it because they don’t want to disrupt the market, so the market tends to react when there’s some fresh news.” There is also a report today that Russia’s Central Bank has raised gold’s share of its reserves and plans to continue doing so.

To an extent $950 an ounce is seen by some as an important trigger point towards the movement to $1,000 gold and it certainly seems that the momentum is with the yellow metal at the moment. Stock markets remain weak, and in reality there seems to be little but gloomy news ahead. Economies are very definitely in recession and confidence in the dollar is not strong. Gold is increasingly being seen by many as the best way of protecting wealth in the current environment.

The only weakness has been the fall-off in demand from the traditionally strong Eastern markets, and if the realization that gold is more likely to move higher than fall back takes serious hold there then, coupled with the continuing movement by western investors into gold, the price increase could accelerate. $1,000 gold may be with us again sooner than expected and this time there is a growing feeling that it could stay there for an extended period. Virtually no-one seems to be betting against this occurring in the very short term – indeed as momentum builds, which it appears to be doing, there could be an explosive price increase ahead in the months ahead.

=============================

===================================

Remember: Don’t Forget about Silver too!

Listed Gold and Silver Stocks Soar – Mineweb

Source: Mineweb.com

Listed gold (and silver) stocks soar

Gold bullion, and listed gold stocks, decouple from a strange and troubled world.

Author: Barry Sergeant

Posted: Tuesday , 17 Feb 2009

JOHANNESBURG –

Precious metal prices moved strongly higher on Tuesday, led by gold bullion, which hopped more than USD 30 an ounce to above USD 970 at one stage, prompting yet another sparkling performance by listed gold equities. Gold bullion is currently trading around seven month highs, and just 6% below the record level it set in March 2008.

At just over USD 14 an ounce, silver is around 34% off its record highs, while platinum at USD 1,085 an ounce is 52% off, and palladium at USD 219 an ounce, a significant 63% off. Demand for platinum group metals has been deeply damaged by reduced demand from the auto sector, which uses the metals in auto catalysts.

Silver stocks, which command a combined global market value (capitalisation) of USD 13bn, currently rank as the best performing equity sub-sector in the world, led by stellar performances from Silver Standard, Fresnillo, and First Majestic. The global grouping of primary silver producers is relatively small, given that the majority of silver is produced as a byproduct at bigger mines; BHP Billiton, the world’s biggest diversified resources stock, ranks as the world’s biggest silver miner.

There are, however, hundreds of listed stocks that rank as primary gold producers. This global grouping currently carries a combined market value of just over USD 230bn, dominated by Tier I stocks; Barrick, the world’s biggest gold name by production and value, currently holds a market value of just below USD 34bn. This ranks Barrick as the world’s No 5 overall mining stock, after BHP Billiton, Vale, Shenhua, and Rio Tinto. Two other Tier I gold producers, Goldcorp and Newmont, now also rank as members of the world’s top 10 mining groups.

While silver stocks, as the small cousin of precious metals, may rank as top equity performers, on a relative basis, the Tier II gold grouping, seen alone, ranks as the world’s leading equity subsector. Some of the top performances in this grouping have been produced by recovery stocks such as Centerra, while JSC Polymetal represents the recovery Russian stock, from a jurisdiction where stock prices were savaged to an extent rarely seen elsewhere.

It is also of interest that some stocks in the global Tier II gold grouping are currently trading close to 12-month highs – a factor virtually unthinkable in any other sector – as seen in the cases of Iamgold, Eldorado, Red Back, and also Franco-Nevada, a royalty, rather than operating, company. It is of further interest that investors have at long last started to move back into Chinese gold stocks in the past few weeks, benefiting the likes of Zijin (Tier I), Zhongjin, and Shandong (Tier II), and Hunan Chenzhou and Lingbao (Tier III).

The SPDR Gold Shares exchange traded fund (ETF), which holds gold bullion on behalf of investors, rather than mining the stuff, is close to trading at all time record levels. The fund currently holds physical gold bullion worth just under USD 31bn; if it were an operating entity, it would rank second only to Barrick. However, if other gold ETFs around the world are also taken into account, the amount of bullion currently held on behalf of investors is worth well above USD 40bn. Silver ETFs, which are trading in price terms in line with silver bullion’s 34% discount from its record high, currently hold close to USD 4bn worth of physical metal.

In terms of individual performances by gold stocks, the top overall Tier I performance award is probably deserved by Kinross; the Tier II award is most difficult, but would likely go to Iamgold, while Novagold appears to be a clear winner among the Tier III grouping. Among developers and explorers, spectacular performances have been put in by La Mancha Resources, Azteca Gold, and San Anton Resource; Central Sun Mining has also shown radical price moves, possibly assisted by corporate action.

| Global tier I gold stocks | ||||||||

| Stock | From | From | Value | |||||

| price | high* | low* | USD bn | |||||

| Goldcorp | USD 32.66 | -38.0% | 136.0% | 23.829 | ||||

| Polyus | USD 32.00 | -60.0% | 128.6% | 6.100 | ||||

| Harmony | USD 11.96 | -17.9% | 118.6% | 5.005 | ||||

| Lihir | AUD 3.47 | -21.0% | 128.3% | 4.840 | ||||

| AngloGold Ashanti | USD 31.10 | -20.5% | 132.6% | 10.995 | ||||

| Zijin | CNY 8.28 | -62.4% | 120.2% | 12.475 | ||||

| Barrick | USD 38.71 | -29.3% | 124.1% | 33.773 | ||||

| Newcrest | AUD 34.28 | -15.4% | 107.1% | 10.502 | ||||

| Gold Fields | USD 11.47 | -31.9% | 147.2% | 7.495 | ||||

| Kinross | USD 19.36 | -29.3% | 182.6% | 12.875 | ||||

| Newmont | USD 42.60 | -22.8% | 101.2% | 20.152 | ||||

| Buenaventura | USD 21.75 | -49.3% | 141.7% | 5.979 | ||||

| Freeport-McMoRan | USD 27.89 | -78.1% | 77.6% | 11.469 | ||||

| [[SPDR Gold Shares ETF]] | USD 95.28 | -5.1% | 44.4% | 30.709 | ||||

| Tier I averages/total | -36.6% | 126.6% | 165.489 | |||||

| Weighted averages | -43.4% | 122.9% | ||||||

| TIER II | Stock | From | From | Value | ||||

| price | high* | low* | USD bn | |||||

| Zhongjin | CNY 50.48 | -58.8% | 121.4% | 2.594 | ||||

| Iamgold | USD 8.24 | -4.8% | 271.3% | 2.437 | ||||

| Simmer & Jack | ZAR 3.24 | -48.7% | 120.4% | 0.335 | ||||

| Yamana | USD 9.42 | -52.7% | 184.6% | 6.903 | ||||

| High River | CAD 0.13 | -96.4% | 212.5% | 0.058 | ||||

| Eldorado | USD 8.68 | -7.1% | 264.7% | 3.197 | ||||

| Agnico-Eagle | USD 55.42 | -33.6% | 165.5% | 8.577 | ||||

| Centerra | CAD 5.23 | -66.2% | 481.1% | 0.895 | ||||

| Randgold Resources | USD 48.49 | -13.8% | 117.6% | 3.709 | ||||

| Shandong | CNY 66.94 | -43.5% | 153.6% | 3.406 | ||||

| Peter Hambro | GBP 5.66 | -63.3% | 262.8% | 0.785 | ||||

| Hecla Mining | USD 1.77 | -86.5% | 78.9% | 0.385 | ||||

| Golden Star | USD 1.69 | -60.9% | 322.5% | 0.315 | ||||

| Franco-Nevada | CAD 27.20 | -0.1% | 134.1% | 2.158 | ||||

| Fresnillo | GBP 4.00 | -30.4% | 330.1% | 4.094 | ||||

| JSC Polymetal | USD 5.30 | -46.2% | 430.0% | 1.670 | ||||

| Red Back | CAD 8.50 | -8.1% | 197.2% | 1.533 | ||||

| New Gold | CAD 2.93 | -69.9% | 211.7% | 0.493 | ||||

| Northgate | CAD 1.74 | -50.1% | 159.7% | 0.352 | ||||

| Tier II averages/total | -44.3% | 222.1% | 43.897 | |||||

| Weighted averages | -42.3% | 188.1% | ||||||

| TIER III | Stock | From | From | Value | ||||

| price | high* | low* | USD bn | |||||

| Western Goldfields | CAD 2.35 | -40.8% | 370.0% | 0.254 | ||||

| Great Basin | CAD 2.10 | -45.2% | 130.8% | 0.357 | ||||

| Sino Gold | AUD 5.59 | -26.6% | 135.9% | 1.040 | ||||

| Alamos | CAD 8.25 | -9.7% | 135.7% | 0.687 | ||||

| Highland | GBP 0.60 | -72.0% | 185.7% | 0.278 | ||||

| PanAust | AUD 0.17 | -86.8% | 101.2% | 0.167 | ||||

| Kingsgate | AUD 4.20 | -33.3% | 90.9% | 0.249 | ||||

| Int’l Minerals | CAD 3.28 | -50.7% | 180.3% | 0.243 | ||||

| Allied Gold | AUD 0.41 | -50.3% | 121.6% | 0.107 | ||||

| First Uranium | CAD 5.15 | -45.4% | 404.9% | 0.617 | ||||

| Novagold | CAD 4.75 | -59.4% | 900.0% | 0.680 | ||||

| Gold Wheaton | CAD 0.29 | -84.6% | 1325.0% | 0.213 | ||||

| Oxus Gold | GBP 0.08 | -74.3% | 113.9% | 0.042 | ||||

| Pan African | GBP 0.04 | -47.5% | 113.3% | 0.063 | ||||

| Citigold | AUD 0.23 | -49.4% | 50.0% | 0.106 | ||||

| Jaguar | CAD 7.15 | -47.7% | 199.2% | 0.362 | ||||

| Pamodzi Gold | ZAR 1.40 | -88.3% | 185.7% | 0.013 | ||||

| Oceanagold | AUD 0.58 | -81.9% | 286.7% | 0.060 | ||||

| DRDGold | ZAR 9.25 | -9.8% | 223.4% | 0.340 | ||||

| Dominion Mining | AUD 4.82 | -1.2% | 152.4% | 0.316 | ||||

| Avoca Resources | AUD 1.92 | -34.2% | 118.9% | 0.338 | ||||

| Integra Mining | AUD 0.23 | -67.6% | 142.1% | 0.057 | ||||

| Royal Gold | USD 43.33 | -13.0% | 90.5% | 1.474 | ||||

| Hunan Chenzhou | CNY 12.84 | -62.0% | 115.8% | 1.005 | ||||

| Aurizon | CAD 4.59 | -15.5% | 279.3% | 0.538 | ||||

| Kazakh Gold | USD 6.80 | -74.8% | 209.1% | 0.285 | ||||

| Gammon Gold | CAD 8.74 | -22.0% | 226.1% | 0.829 | ||||

| Crew Gold | CAD 0.11 | -94.6% | 110.0% | 0.071 | ||||

| Lingbao | HKD 2.42 | -56.0% | 202.5% | 0.093 | ||||

| Zhao Jin | HKD 8.57 | -54.7% | 360.8% | 0.483 | ||||

| Rusoro Mining | CAD 0.70 | -63.7% | 197.9% | 0.216 | ||||

| Minefinders | CAD 6.59 | -51.2% | 97.9% | 0.308 | ||||

| Andina Minerals | CAD 1.98 | -57.3% | 280.8% | 0.125 | ||||

| Crystallex | CAD 0.36 | -87.6% | 260.0% | 0.084 | ||||

| Ramelius Resources | AUD 0.57 | -54.0% | 52.0% | 0.067 | ||||

| Tanzanian Royalty | CAD 4.96 | -21.5% | 149.2% | 0.349 | ||||

| Minera Andes | CAD 0.64 | -66.7% | 100.0% | 0.096 | ||||

| Semafo | CAD 2.07 | -1.4% | 176.0% | 0.381 | ||||

| Tier III averages/total | -50.1% | 225.7% | 12.991 | |||||

| Weighted averages | -51.9% | 170.0% | ||||||

====================

In my opinion you need to move now and move quickly and get on this great Bull Market in Gold and ALL Precious Metals -jschulmansr

My Disclosure: Long Many of the Tier’s 1, 2, 3 mining stocks, Precious Metals Bullion, Long DGP,GDX, CES, ROY. You might say I am a Gold Bug and Proud of it! Good Investing! – jschulmansr

============================

Nothing in today’s post should be considered as an offer to buy or sell any securities or other investments, it is presented for informational purposes only. As a good investor, consult your Investment Advisor, Do Your Due Diligence, Read All Prospectus/s and related information carefully before you make any investments. – jschulmansr